Indigenous Investors Weekly Insights!

Top 3 well curated stories from the stable of Indigenous Investors incase you missed them. These can range from finance to sports, depends on what made the headlines. Stay tuned.

This week, we cover the following:

Government selling its stake in PSUs and PFIs

EU pushes India to cut high import taxes in trade talks

RBI reverses NBFC Loan Rules

Story #1: Why is the Government Selling Its Stake in PSUs & PFIs? (click here)

Why government has decided to sell their stacks in Public Sector Units (PSUs) & Public Financial Institutions (PFIs). FM had already announced in 2021-22 for privatization of certain government institutions to be their long term target. This will be done to comply with SEBI’s minimum public shareholding guidelines that require listed firms to maintain a free float of minimum 25%. The government holds higher stake in five banks – Bank of Maharashtra 86.46%, Indian Overseas Bank 96.38%, UCO Bank 95.39% Central Bank of India 93.08% Punjab & Sind Bank 98.25%.

The same goes for insurance companies like LIC, GIC & New India assurances, which must bring its public shareholding up to 10% by May 2027. There are challenges to this as selling too many shares at once could low the stock prices. Also, selling in current market conditions will not fetch decent returns. The aim of this process is to sell shares smartly, without losing value, while also making India’s banking sector more open to private investment.

Story #2: EU Pushes India to Cut High Import Taxes in Trade Talks (click here)

India charges 150% taxes on wine import & 70%-100% on car imports. EU is continuously asking India to reduce high import duties on cars, wines, and spirits as a part of Free Trade Agreement discussions. EU is working to reduce its dependence on China and sees India as a strong and long term trade partner with EU officials from 21 countries visiting India. In this discussion also involves India’s position on India-Middle East-Europe Corridor (IMEC) & topics like artificial intelligence (AI), digital regulations, and China global trade. EU expect to India gradually reducing some import duties.

US President Donald Trump has already called India as “tariff king”. Having already reduced their fiscal income in the budget through new income tax slabs, the government of India now faces a big challenge to protect its fiscal income, maintain its forex reserves, safeguard its domestic industry and at the same time exhibit its attractiveness as a preferred trading partner globally.

Story #3: RBI Reverses NBFC Loan Rules to Boost Bank Lending (click here)

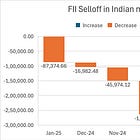

The RBI has decided to reverse its earlier decision to increase risk weights on bank loans to non-banking financial companies (NBFCs). This means banks will need to set aside less capital, allowing them to lend more to NBFCs and the change takes effect from April 2025. When RBI raised risk weights by 25% in November 2023, bank lending to NBFCs fell sharply. Loan growth to NBFCs dropped from 15% in December 2023 to 6.7% in December 2024.

Since NBFCs relied on banks for 47% of their borrowing before November 2023, many had to seek alternative funding sources such as capital markets and external commercial borrowings (ECBs). However, rising dollar costs made ECBs more expensive. The RBI also clarified risk weights for microloans which will now have a 75% risk weight, while consumer credit loans will carry a 100% risk weight. Earlier, both had a 125% risk weight, causing confusion among banks. This adjustment benefits small finance banks, which have large microfinance portfolios.