Indigenous Investors Weekly Insights!

Top 3 well curated stories from the stable of Indigenous Investors incase you missed them. These can range from finance to sports, depends on what made the headlines. Stay tuned.

This week, we cover the following:

Insurance major Allianz to split their 24 year journey with Bajaj, Jio enters

India fails to capitalise as its exports drop to 20 month low along with dropping imports

India imposes 12% safeguard duty on Steel imports

BONUS - Beautiful vs Practical advice

Story #1: Insurance major Allianz to split their 24 year journey with Bajaj, Jio enters (click here)

Bajaj Finserv and Allianz SE announced that they will be breaking ties from their 24 year old relationship and Bajaj will be buying its full stake in life and general insurance category for a sum of INR 24,180 crores after which, Bajaj will be the 100% owner of the insurance business.

Allianz however, said that India remains a market of their focus for their insurance business and wish to have a partnership where it can have better control of the business than being a mere investor on the sidelines.

Buzz in the market is that Jio Financial Services have extended their hand to partner with Allianz in order to expand their financial services business to include life and general insurance and the executives from both companies are negotiating since months.

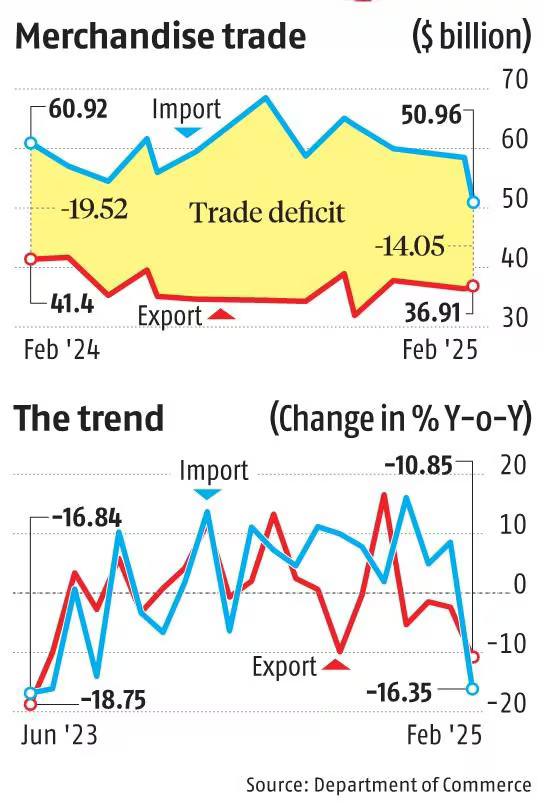

India’s trade deficit has dropped from USD 19.52 billion to USD 14.05 billion in February 2025. While this is a good thing, India has failed in capitalising on the opportunity of reducing this gap by a large extent.

India’s imports fell due to softening of oil prices by about 29% and dropping of gold imports by 62%. These two commodities enjoy the biggest shares when you see the list of value of goods imported into the country.

Our economics professors always taught us that when the INR depreciates - i.e. goes from INR 80 / USD to 85 / USD, it is better for our export as they get cheaper and at the same time we are able to earn more per dollar earned. However, in spite of the rupee hovering around all time low numbers, our exports have gone down by over 10%.

Story #3: India imposes 12% safeguard duty on Steel imports (click here)

The Directorate General of Trade Remedies (DGTR), under the Ministry of Commerce and Industry, has recommended a 12 per cent safeguard duty on certain steel products for 200 days to protect the domestic industry from what it describes as “serious injury” caused by a recent surge in such imports.

This comes as a result of USA increasing 25% tariffs on steel and aluminium imports and China dumping their products in other countries.

If implemented, the safeguard duty could raise raw material costs for micro, small, and medium enterprises (MSMEs) and steel-dependent industries at a time when global steel prices are expected to soften.

When large Indian Iron & Steel manufacturers are sponsoring IPL Teams, the Government doesn't care (rightly so). But when they can't compete with China, then they go on imposing cosy safety nets (safeguard duty) and helping Indian manufacturers get away with inefficiency and high price.

BONUS - Beautiful vs Practical Advice (click here)

If you love to read an article that flows like a river, do click on the above link. When Morgan Housel writes, you leave everything else, pick a quiet corner and read.

We have been firm believers that PERSONAL FINANCE IS MORE PERSONAL THAN FINANCE. Morgan’s seamless writing shows exactly that.

No two people are alike, and financial advice that’s useful for you could be disastrous for me and vice versa. There is no one-size-fits-all financial plan – a fact that’s easy to overlook because people want to think of finance like it’s physics, with clean formulas and absolute answers. When advice needs to be personal but you think it’s universal, it’s common to default to what sounds the best, the most intelligent, and the most complex. People drift from practical towards beautiful.

Our other posts you might want to read!