Indigenous Investors Weekly Insights!

Top 3 well curated stories from the stable of Indigenous Investors incase you missed them. These can range from finance to sports, depends on what made the headlines. Stay tuned.

This week we cover the following:

Paytm’s consolidated net loss narrows

Aether reports strong earnings as net profit for FY25 rose 92% year-on-year to ₹158.42 crore, compared to ₹82.49 crore in FY24

PVR Inox’s Hindi box office collections fell 26% due to fewer Bollywood releases and postponements, while English box office saw a 28% drop, partly due to the Hollywood strike

Bonus: Rebalance when you can, not when you're on tilt.

Our thoughts are with the families who lost their loved ones in the Pahelgam terror attack and subsequent cowardly attack by the Pakistan armed forces in the last few days.

Since this is a financial newsletter, let’s just have a closer look at the Pakistan’s economy and why does this war mean so much to them.

Last weekend, we witnessed an announcement of ceasefire between India and Pakistan. Out of nowhere, Pakistan’s Prime Minister announced it’s victory over India and made some tall claims. This infuriated all of us.

India’s Prime Minister Narendra Modi remained silent on the matter.

Anger levels of Indians were rising at that point.

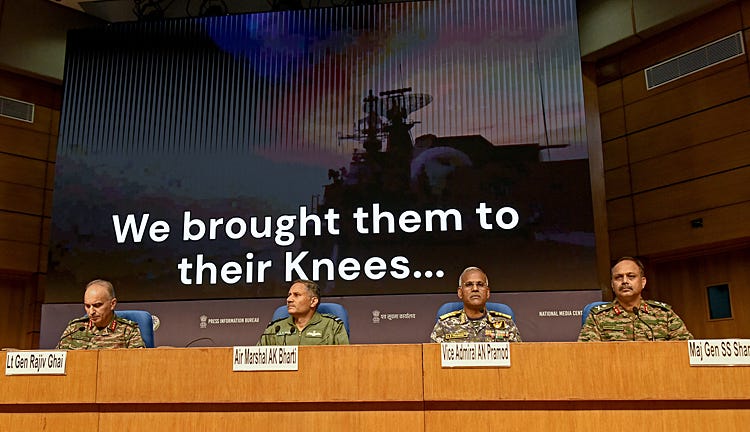

Then came a masterclass of Indian army with our 3 DGMOs of Army, Navy and Air Force showing proof of Operation Sindoor.

Confidence, conviction and fearless - their body language says it all.

These photos literally calmed the entire country down and brought Pakistan’s cricketer Shahid Afridi on the streets claiming some sort of moral victory. Then came a detailed briefing from Pakistan’s armed forces which was more like a Laughter Challenge as they struggled to showcase facts.

The whole World understood the might of India’s armed forces. It was professional, brief and a clear intent that if Pakistan choses to engage with India for wrong reasons, then they can wipe out that country within a matter of 2 weeks.

Pakistan in the meanwhile obtained a $ 1 billion loan from IMF. India abstained from voting on the matter.

Now, this is critical.

As Geopolitical observer, this loan is not about IMF’s stance on the war or anything. It just showcases how Pakistan’s economy is completely bankrupt. You can read IMF’s commentary here.

Here’s the highlight!

”The steadfast implementation of the FY2025 budget and the passage of key fiscal reforms, notably the Agricultural Income Tax, underpin the process of rebuilding policy making credibility. Continuing to mobilize greater revenue from undertaxed sectors and the noncompliant will make the tax system more equitable and efficient.”

“Timely implementation of power tariff adjustments has helped reduce the stock and flow of circular debt.”

Firstly, Pakistan has imposed an agricultural income tax which means even the marginalised citizens who are living on less than $1 per day will now have to contribute to taxation so that IMF can recover their money.

Can you think about such a thing ever happening in India?

Secondly, all the power companies of Pakistan are bankrupt. There are frequent power cuts almost everywhere. One can only imagine how the people of Balochistan survive without adequate water, electricity, hospitals and schools.

It’s hilarious to note that, the economies of Indian states like Maharashtra and Tamil Nadu have now surpassed or are on par with Pakistan’s total GDP of $373 billion.

For example, Maharashtra’s GSDP is estimated at $490 billion and Tamil Nadu’s at $341 billion in 2025.

There’s absolute chaos in the country.

Now, as an army officer and a political leader, you need a distraction because the economy isn’t working. A war is now needed. Hence, terrorists play a vital role who are ready to lay down their lives for just nothing. These kids are trained to be cold blooded and brutal in the name of religion.

India on the other hand cancelled the Indus Water Treaty which was like Uno Reverse to the Pakistan’s corrupt minds.

Now just imagine, if 80% of your country’s water is blocked then how will you recover any taxes from Agriculture and how will you cool down your power stations?

It’s a masterstroke by India and somewhere one has to admit that only Narendra Modi had the guts to do it.

Pakistan will have to now disclose everything to the World about how the money is being deployed. That’s why we see the likes of Turkey, USA, Azerbaijan and others are supporting the terrorist state.

It’s time the world sees what’s in their cards.

And we are watching the initial glimpse from their media and parliament houses spreading fake news to their own public. The world is noticing how they are simply intoxicating their own people with their own propaganda.

With that, let’s take a look at how India’s Equity Markets performed this week.

source: Indigenous Investors Research Desk

Now let’s go through our weekly stories.

Story #1: Paytm’s consolidated loss narrows (click here)

source: Indigenous Investors research desk, Perplexity AI

Adjusted EBITDA Break-even: Paytm achieved adjusted EBITDA break-even.

Lending Business:

Personal loan value declined quarter-on-quarter, attributed to the tightening observed in the industry. The company is moving towards a pure distribution model for personal loans, where lenders handle collections.

Merchant credit business grew healthily, and this trend is expected to continue.

UPI Monetisation (MDR):

Management sees talks of MDR coming on UPI for larger merchants and believes it should show up sooner rather than later.

They expect this to bring monetization opportunities for QR deployment, acquiring, and the consumer app.

Consumers are not expected to be charged on UPI.

Impact of AI:

AI is leading to automation and increased productivity per employee.

AI has helped achieve efficiency gains in software, cloud, and data center costs, leading to a 10% sequential decline in these expenses.

Consumer User Base:

Growing the user base to 200 to 250 million highly repeat users is a goal, focusing on material users who matter to the platform.

User base growth is currently driven by product improvements and better product attention, achieved at a dramatically lower cost than previously, without significant marketing expenditure.

Medium-Term Financial Targets:

Paytm is targeting revenue growth in the 30-35%+ range and EBITDA margins in the 15-20% range for the next year and longer term.

Paytm Money:

Paytm Money, the equity broking platform, is not yet a very large business but is seen as a great upside opportunity. It offers services like mutual fund distribution and margin trading (MTF).

It is estimated to have an annualized revenue scale of around ₹200-300 crores.

source: Indigenous Investors research desk, Perplexity AI

Key Highlights

Units sold: 155,394 units sold, representing a +42% YoY growth.

Total Income: INR 23,052 million, showing a +29% YoY growth.

EBITDA Margin (%): Improved to (23%) in FY25 from (36%) in FY24, a +1300 bps YoY improvement.

Adjusted Gross Margin (%): Increased to 19% in FY25 from 9% in FY24, a +1000 bps YoY improvement.

Adjusted Gross Margin without subsidy (%): Showed a +1800 bps YoY improvement in FY25.

Operational Highlights of FY25:

New products launched and delivery commenced: Rizta, Halo, and Halo bit.

Experience Centres: Increased to 351 in India, with +143 added in FY25. The majority of stores added were in the non-south region (69%), with a capacity to add 2 stores per day. Store additions quarterly in FY25 were +10 (Q1), +13 (Q2), +34 (Q3), and +86 (Q4).

Charging points: Increased to 3,611 (Fast charging grid and Ather Neighbourhood chargers), with +1,128 added in FY25.

International Expansion: Commenced expansion to Sri Lanka.

Market Share:

Ather established market leadership in the south.

Market share in the south reached 21.7% in Q4FY25, up from 13.6% in Q1FY25. Ather was #1 in market share in the south in Q4FY25.

India market share (excluding Telangana) was 13.3% in Q4FY25, up from 7.4% in Q1FY25.

Overall E2W Market Share was 11.4% in FY25 compared to 11.5% in FY24.

source: Indigenous Investors research desk, Perplexity AI

FY25 Performance and Financial Overview

The box office in FY25 experienced an uneven release slate across quarters, leading to noticeable content gaps and fluctuations in theatrical performance.

Performance of both Bollywood and Hollywood films was below expectations. This resulted in a 9% drop in overall gross box office collections for the company.

Specifically, the indie box office dropped by 26% due to fewer releases, no major superstar films, and postponements. Bollywood collections were down by 28%.

In contrast, Hindi dubbed collections surged by over 150%, indicating a shift towards big pan-India stories. Chava was the biggest hit of Q4, boasting around 700 crores at the box office.

Financially, for Q4 FY25 (after adjusting for Ind AS 116 on lease accounting), total revenue was 1285 crores, EBITDA was 25 crores, and PAT loss was 106 crores.

This compares to revenue of 1290 crores, EBITDA of 35 crores, and PAT loss of 90 crores in the same period last year.

PVR INOX welcomed 30.5 million guests in Q4 FY25 and 136.9 million guests in FY25. Despite content challenges, they maintained a steady Average Ticket Price (ATP) of 259, same as the previous year.

Strategic Initiatives and Cost Control The company transitioned from merely managing footfalls to proactively manufacturing demand and enhancing audience engagement. Key strategies included:

Curating re-releases, which contributed an incremental 7.1 million footfalls and approximately 124 crores in gross ticket collections during the year.

Successful execution of four Cinema Lovers Days and one National Cinema Day, offering tickets at 99 rupees.

Launching Blockbuster Tuesdays, a weekly initiative with tickets at 99 or 149 rupees.

Balancing value promotions with strategic pricing on big releases.

Other Points

The current OTT window is 8 weeks and is expected to increase. Content makers acknowledge theatrical release as the biggest monetisation window. OTT platforms prefer to see theatrical performance before buying movies.

FY26 total capex is expected to be roughly 400-425 crores, allocated across new projects (250-300 crores), renovations of existing properties, maintenance, and IT related capex.

Bonus: Rebalance when you can, not when you're on tilt.

Personal finance advisors and especially these Goal Planning Apps these days are taking a video game approach rather than actually understanding the clients and their behaviour with money.

Based on a few inputs, a strong Excel sheet is prepared. Basic premise being that you can make data dance to your tunes when you stress it enough.

Rebalancing the portfolio is one strategy. The shift from equity to debt, gold and vice versa.

Now this key strategy works when the investor is in a stable mindset. Not when the excel sheet says so.

Let’s say Nifty 50 being at an all time low, everyone will shout invest, invest. But it’s not easy. We are humans after all.

Yes, these are missed opportunities that will eventually drain you off from some imaginary hundreds of crores. That’s delusional. And yet the entire personal finance machinery stays silent on this.

Honestly, there’s no real need to catch the top or the bottom of the market. Average returns of 12 to 15% are enough for you to retire comfortably.

Until that happens, you need to ask yourself a simple question - do you want to enjoy your life or have sleepless nights?

Take a look at this.

While Indians are increasing their monthly SIPs, fund managers are taking a cautious approach. They are not investing your money at the moment.

You might find this strange.

Here’s what our dear friend Mr Amardeep had to say on the matter.

“On a 12-month trailing Nifty’s EPS (Earnings) have continued to slow down considerably. In the past 5 quarters, earnings growth has slowed from 24% > 18% > 14% > 12 % to the current growth of 6%.”

So while investors are confident in India’s markets. Our top 50 companies seem to be struggling to grow their earnings.

Will you rebalance your portfolio now?

Think about it.