Indigenous Investors Weekly Insights!

Top 3 well curated stories from the stable of Indigenous Investors incase you missed them. These can range from finance to sports, depends on what made the headlines. Stay tuned.

This week we cover the following:

India eases coal supply rules to ramp up power generation capacity

Voltas and Blue Star come out with some smashing numbers

SIP contributions hit record high of ₹26,632 crore in April 2025: AMFI

Our thoughts and prayers are with the families of those who lost their loved ones in the recent terror attacks orchestrated by Pakistan. Losing a loved one in a matter of seconds is not easy to digest, the ones who have gone through it, understand.

"He who knows when he can fight and when he cannot, will be victorious." - Sun Tzu

India has given a strong response to these harbingers of terrorism and also drained them off their resources. Our Prime Minister Narendra Modi has put exceptional leadership and tactical ability on display. The result is that Pakistan is exposed to the World now and developed economies don’t want to touch the country with a 10 feet pole.

There are some people who feel that Modi has done this to gain votes for upcoming elections. It literally breaks our heart to hear such statements. We feel that no medicine in the world can cure this anti-Modi disease in such people. As a result, we choose to stay silent on this subject.

However, we would like to repeat what our government has said and remind everyone around you -

The so called ‘act of war’ by India is only retaliatory in nature. We did not start it. We never meant to start it. But we are not the India anymore that will sit quietly if someone hurts us. We are doing this to Pakistan because their government and military are equally involved in scouting, grooming and training terrorists and it is overdue that they get the reply in the language they understand.

Having said that we also request you - take utmost pride in the steps our government and armies are taking - and be vocal about it. Unconditionally support our armies and government in whatever they do.

Total spending on the Defence sector by the Government of India

source: Indigenous Investors, Perplexity AI

Adding these annual allocations, the total defence spending over these 12 years is approximately ₹ 6,011,298 crore or ₹ 60.1 lakh crore.

That’s a huge amount!

Just to put a little context to this.

Government of India can spend on our Defence systems only when we pay our taxes properly. It’s our right to complain when we don’t get proper roads, clean water or proper electricity.

And it’s also our duty to applaud the Government to effectively use this money by firming up our defence systems by purchasing the S-400 Sudarshan Chakra that helped saved civilians in Jammu, Bhuj, Jaisalmer and so on.

Operation Sindoor was a masterstroke. It showcased our strength. Our drones can go undetected in enemy territory upto 500 kms from the international borders and neutralise their defence systems. Just like playing a video game on expert mode.

We firmly believe that this is money well spent!

So now, let’s get to the question of the week that we’ve been asked about:

If there’s a war, what will happen to India’s stock market and should we sell now to purchase these stocks at a lower price later on?

Our thoughts:

This is not a war of equals. India has cornered Pakistan from all fronts at the moment. Yet, the world is more interdependent on each other than what it was a few decades back and it is in the interest of not only India - but the world that this war ends soon.

India is one of the most preferred destinations for businesses worldwide. We still may not be perfect, but we are lucrative enough from the standpoint of the size of our market, our talent, cost, adaptability, natural resources and many other aspects. The way we have attracted FDIs for over a decade are a testament to this.

On the other hand, the Chinese investment in Pakistan, primarily through the China–Pakistan Economic Corridor (CPEC), has reached approximately $ 68 billion as of 2022–2024. (click here)

China has mainly invested in Pakistan’s Energy and Infrastructure sector. These projects such as railways, highways, ports, power generation projects, etc are at a risk when Indian planes can simply decimate them in a matter of seconds.

Other countries such as Saudi Arabia, UAE, IMF, World Bank, Japan, UK, US, EU and a few more too have loaned their money to Pakistan which will be at a risk of default if this goes full scale.

Pakistan is run by highly incompetent ministers and army personnel who will want to claim victory even at the cost of their people’s lives. They can go rogue any moment. So that’s an extreme risk which is still present.

So we are not ruling out an impact on our stock market.

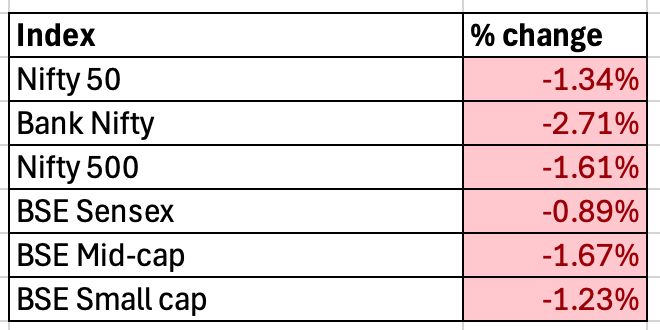

Here’s how the India’s stock indices performed this week.

source: indigenous investors research desk

Here’s a fun fact.

KSE:100 premiere Index of Pakistan’s stock exchange has fallen by 13% since April 22, 2025 (date of Pahelgam terror attacks) while India’s Nifty 50 has just fallen by 1%.

Now, let’s address the second part of the question, should you sell your portfolio to re-enter at a lower level?

This is a question that enters every investor’s mind regardless of their experience or exposure of the equity markets. This is what makes us human. We tend to question our decisions in uncertain times.

That’s why we follow some simple frameworks that we would like to share today.

First (extreme) - Will India stop consuming tomorrow?

If the answer is No, then you need to be sure that the stock markets will return from a little correction.

Stock markets are simply a reflection of businesses in an economy. If 140 crores of Indians live tomorrow, they will consume food, clothing, education, transport, etc to live their life. They will need basic Government facillites such as roads, railways, electricity, water, etc.

So yes since the economy will still be breathing, your portfolio will not collapse. That should be first line of thought.

Second (moderate) - What will happen to my portfolio?

Markets are a combination of fundamental earnings potential of companies and sentiments of people trading them. Hence, the fluctuation in prices are a result of greed and fear embossed in it.

All you need to do is, just go back to your wealth or portfolio manager and sit with them to understand if there’s something that has been bought at a higher valuation.

If your portfolio is bought within the valuation comfort then you don’t need to worry. Because when this bearish cycle is over, your portfolio will start to boom.

Third (easy) - Will you be able to buy at lower prices?

Just ask yourself - were you able to invest with conviction when equity markets were at their lowest? Can you do it consistently? Are you aware of the bottom when the bottom actually arrives?

It’s not easy to buy something at their lowest possible point because there are so many bad news surrounding it. Hence, it’s relatively easier to buy at a fair valuation then wait for prices to keep constantly go lower.

All this unnecessary churn only causes the portfolio returns to deteriorate in the long run because of transaction costs, taxes and most importantly - missed opportunities.

Hence, unless you have bought something at extremely high valuation, it’s better to think long term and sit out this entire episode.

A reputed fund manager had told us a few years back - Inaction, is also an action.

In these times of uncertainty, the one thing we can leave you with is - if you want your money within this year for any of your planned expenses, you may think of shifting to a safer option like any debt instrument.

However, if your money is going to stay invested for the long term, do not disturb it and let it work its own magic.

With this in the background, let’s look at 3 top stories of the week.

Story #1: India eases coal supply rules to ramp up power generation capacity (click here)

India’s requirement for power is expected to grow at a rate of 8 - 9% CAGR for the next few years. As we will see more data centres, manufacturing activity and a steady growth of our services sector.

Coal is our primary source of electricity. 46.4% of our energy comes from Coal. Solar power comes close second at 22.2%

In order to meet the ever growing electricity demand, it’s important to increase the coal supply. Hence, the coal supply regulations have been relaxed to support the expansion of coal-fired power generation.

Independent power producers can now enter long-term coal supply agreements-even without power purchase agreements (PPAs) and acquire coal via auction for up to 25 years by paying a premium.

This is huge. Because we are reducing paper work and involvement of Government babus who are prone to not only delay everything, but also increase costs.

Intention is to encourage more investments from the private sector in coal based power plants. Easing regulations is first step in this process. Let’s see how private players look to lap it up.

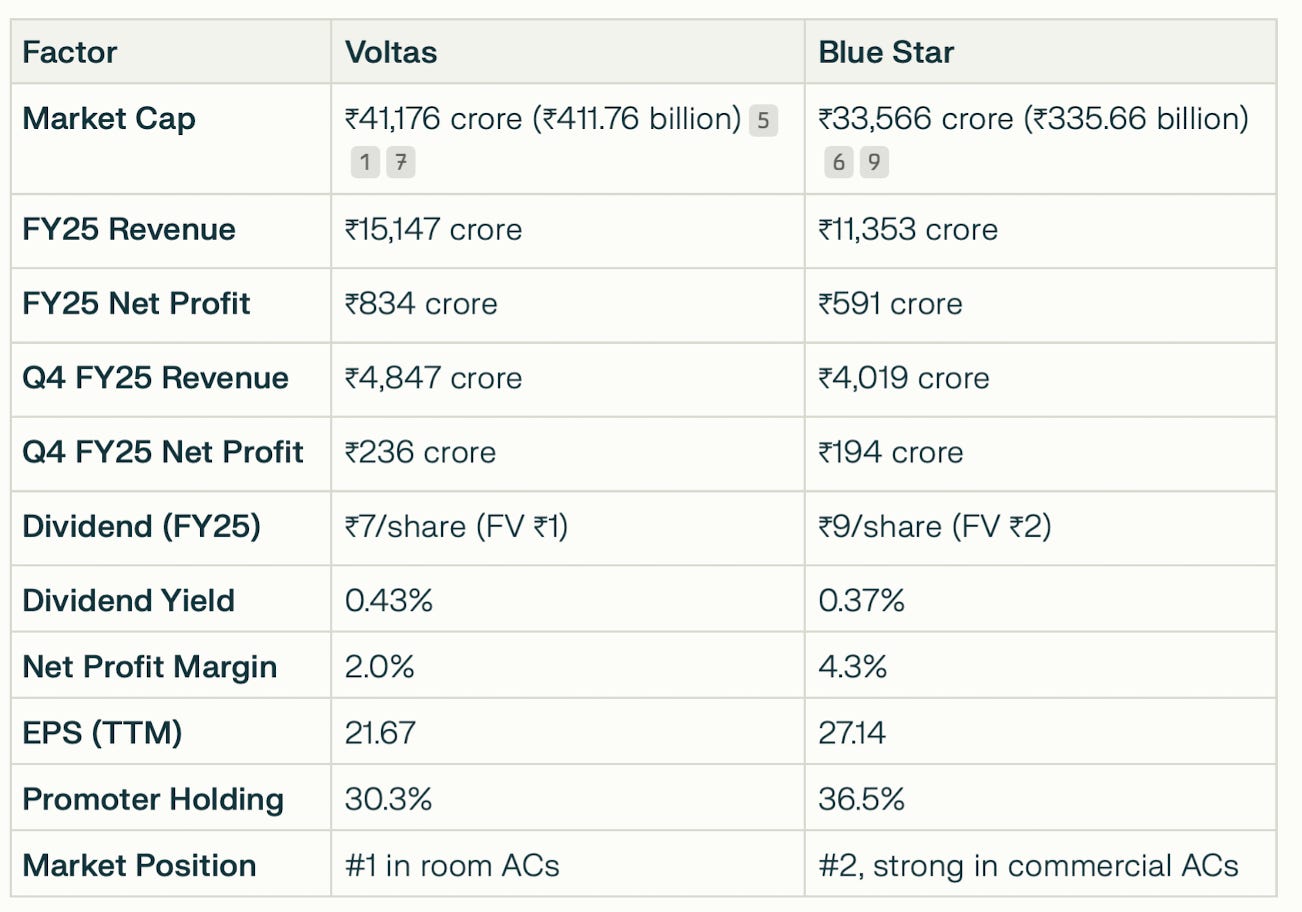

Story #2: Voltas and Blue Star come out with some smashing numbers

Click here for Voltas Click here for Blue Star

It’s hard to believe that India’s AC penetration is around 7 to 8% odd.

Since we live in cities, we see AC installations everywhere. Hence, we tend to believe that almost everyone is using it and no one is living without it.

It’s when you travel outside Metro and Tier 1 cities, a different India starts to emerge. Suddenly, we see lack of basic facilities provided to them. So AC is completely out of question.

However, it will be wrong to believe that these folks don’t want to use such modern technologies. They definitely want to and their need increases with rising temperatures due to global warming.

They aspire to use a smartphone, air conditioners, faster motor bikes, sedan cars, so on and so forth. Now add the guys from Bajaj Finance simply lend them on zero interest rate, a possibility emerges.

Hence, we at Indigenous Investors see a strong pick up in the AC market in the coming years.

Voltas and Blue Star are the darlings of the stock markets as of now. Here’s a brief comparison.

source: Indigenous Investors research desk, Perplexity AI

A lot of international players in this segment will emerge along the way because the market is too big for any 1 or 2 companies to capture.

Hence, there is tremendous value for shareholders. However, they will have to do their research well before entering any of these stocks. Just riding the wave won’t be enough.

Story #3:: SIP contributions hit record high of ₹26,632 crore in April 2025: AMFI (click here)

The industry added 46 lakh new SIP accounts in April, higher than the 40.19 lakh added in March.

Mutual Fund Industry Growth:

Total assets under management (AUM) hit a record ₹ 70 lakh crore in April, up from ₹65.74 lakh crore in March.

Overall equity inflows fell for the fourth straight month to the lowest in a year, despite strong SIP momentum.