Indigenous Investors Weekly Insights!

Top 3 well curated stories from the stable of Indigenous Investors incase you missed them. These can range from finance to sports, depends on what made the headlines. Stay tuned.

This week we cover the following:

July 9: Remember the date as India - US Tariff Dispute (Trade deal) is now entering it’s final stages!

FIIs seem to be opening their arms (SRK pose) to Gravita India - a leading company in lead and aluminium recycling.

Is Gold Jewellery a Good Investment? Beware 30% Hidden Loss!

The victims and the families of Pahalgam Terror attack and the crash of Air India’s London bound flight are still in our thoughts as we write this newsletter. It’s difficult to absorb such information and still lead our lives in a normal way.

Now, let’s look at how the markets performed this week:

Equity markets were absolutely flat this week. It’s a sort of cooling down period after the recent rally.

As from the next week onwards, Q1 results (April - May - June 2025) of companies will be released.

We see a mixed bag coming into play.

There’s hardly been a significant Capex announcements from large companies despite RBI making loans cheaper for them. In the Urban India (Metro cities + Tier I and II towns) - there is stagnation with regards to earning and spending money.

Rural India is where there is a pick up in terms of spending. It’s interesting as companies like Vishal Mega Mart who primarily operate in those areas are reporting good numbers.

Large IT companies, Banks and NBFCs will set the tone for the results. However, we don’t see too much happening in that space at the moment. Everyone is currently on a wait and watch mode till the time businesses get a sense of direction from the ongoing tariff dispute and war scenarios.

As Government pushes for more Capex, it’s hard to see Commodity cycle peaking out.

These are just some messy thoughts in our head at the moment. There’s no guarantee that our thesis will turn out right.

US President Donald Trump seems to be missing his childhood days. Back when everything was so easy, one could play video games all day (in our times, not his), then go out and blame everyone for his under performance, straight away spread lies about brokering peace between countries, take on the biggest bully by first making him his ally and then biting him in the back, so on and so forth.

This is what we as distant observers are able to see.

Businesses and stock markets around the World are glued to X (formerly Twitter) about any announcement from Trump.

Funnily though, there is a strong claim (meme) that has appeared on social media about Trump taking the credit of changing the regime in Phulera (Panchayat - an Amazon Series we just love). Take a look.

image credit - x.com, it’s a meme.

Incase you haven’t watched the Season 4, we highly recommend you to do so. It’s not the spoiler, it’s the build up of the story that creates magic.

Back to Trump and Modi, their bonhomie and trade deal.

India has slowly started reducing some heavy tariffs on products imported on products from UK and US. At the same time, India has put a lot of Anti-Dumping Duties on Chinese products (it’s a fascinatingly long subject, so some other time).

In 2025 alone, India has shown willingness to reduce tariffs in the following areas as part of its ongoing trade negotiations, particularly with the United States:

Walnuts

Cranberries

Other fruits

Medical devices

Automobiles

Energy products (such as liquefied natural gas and oil)

So where’s the deadlock?

It’s Agriculture!

“The US has been pushing India to significantly open its domestic market by reducing tariffs on American farm goods like soybeans, wheat, corn, apples, ethanol, and dairy products, many of which are politically sensitive in India. Washington has also demanded easier market access for genetically modified (GM) crops, which New Delhi has long resisted due to health and regulatory concerns.

India, however, has refused to budge, citing the need to protect its small farmers and food security system, particularly the Minimum Support Price (MSP) regime that underpins rural stability and welfare.”

Trump seems to be in a mood to play UNO with India as we have studied and continue to study that Agriculture is the backbone of our economy.

As more and more children are getting educated, they are opting for service based jobs instead of working in the Agriculture sector. That’s why Indian media talks about someone topping their school, college or state and aiming for some dream job at a Fortune 500 company. Somehow that’s the definition of success!

Although if you zoom out a little, you realise that there are so many people still employed in Agriculture sector. A number that we simply take for granted.

Close to 21.49 crore of our population is employed in Agriculture.

Below is the breakup from Dubey & Chaturvedi’s recent work of India at work.

Agriculture’s importance can be assessed from it’s value added to our GDP numbers. In simple terms, just see how slowly and steadily the entire sector has been contributing to the Indian economy.

Skeptics tend to have an attitude of ‘so what’ with these things.

Because rational skeptics are always focussed on the future and they read a few blogs and listen to some media houses to arrive at their conclusion.

Hence, we always receive this statement from such people that ‘Agriculture’ is not the sector of tomorrow. It’s going to be AI, Machine Learning, LLM, etc - all these things we don’t even understand in the first place.

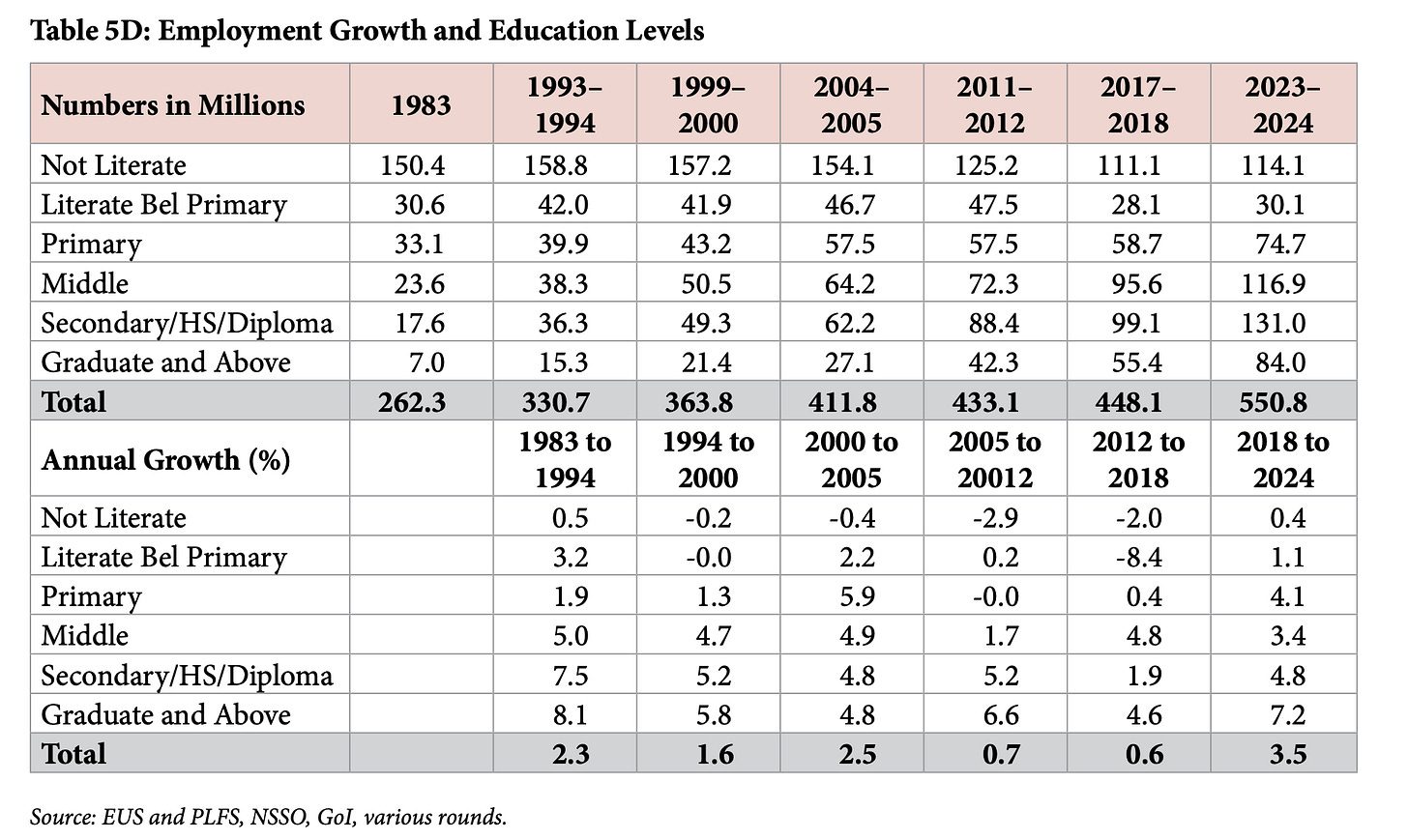

For them, here are a few numbers from the same report.

If you look at the first table closely, India still has a record 11.4 crore people in the employment system who are not literate, then comes another 10 crore who have barely studied till primary school.

That’s 21 crore of our population which is doing odd jobs and are treated as casual labour which can be dispensed off whenever not required.

Slowly, we are seeing a rise in people who have completed their 10th standard, secondary and graduates. (Quality of education is not the question here)

The change is real.

But we cannot dispose off those 21 crore people are reliant on odd jobs and agriculture in the name of a trade deal.

In our observation, Indian government is taking the correct stance in this whole thing.

Think about it.

In addition to agriculture, the US is also seeking

Greater access for American dairy and processed food companies.

Lower tariffs on electric vehicles, alcohol, and agro-biotech products.

Reductions in non-tariff barriers, including product certification and labelling rules.

Lower tariffs on soy oil, which India imports in large volumes.

Honestly, that’s crazy and shouldn’t be allowed.

Now, it’s down to the game of who blinks first.

India has an advantage of a trade surplus with US because of our services sector. But then, Trump really doesn’t care about it. His job is create ruckus in the Global system and showcase to his electorate on how powerful he is and how US can be the bad boy!

Story #2: FIIs seem to be opening their arms (SRK pose) to Gravita India - a leading company in lead and aluminium recycling.

source: screener.in, Indigenous Investors Research Desk

During the past 4 years, we have been reading about a constant Foreign Institutional Investors (FII) outflow. They have been selling their Indian stocks and putting money elsewhere.

Here’s a chart.

source: perplexity.ai, Indigenous Investors Research Desk

It’s been the Domestic Institutional Investors powered by the monthly SIP money that is pushing the market upwards to say the least.

So when FII is leaving out of Indian stocks and at the same time slowly adding their stake in a commodity - mineral recycling company, it deserves a closer look.

Since our investigation in India’s recycling sector and waste management sector is ongoing, there’s a fair chance that we might have not covered the entire ground. But in order to crystallise our thoughts, we are taking this bold attempt to write a few things.

Gravita India makes 88% of it’s revenue from lead recycling and the rest from aluminium and plastic products (as per company docs).

Lead is majorly used in batteries, medical imaging equipment, bullets, alloys, paints, plastic stabilisers, etc..

In a nutshell, it’s an important resource that shouldn’t be wasted away.

Plus, these critical minerals should be recycled as much as possible rather than digging the Earth or importing from China (as usual).

Indian Government is taking steps for the same.

Gravita at the moment is just a Rs 13,000 crore in market cap which is very small in nature. The company wants to venture into New recycling verticals in Rubber, Lithium, Steel & Paper. As a result, a proper Rs 600 crores of Capex plan has been put in place.

This is exciting stuff.

Recycling and Waste Management maybe a small pie for the FII at the moment but they are happy to tell us as India is a Consumption economy. So all of us (retail investors) will rush to buy Titan, Asian Paints, Nestle, HUL, ITC, etc which they are happy to sell.

At the same time, they are looking out for these companies where the waste will get processed and recycled or repurposed.

This is just the start for them and how silently they are buying small chunks without anyone having to notice the same.

This is exactly what a retail investor needs to be aware of.

Don’t buy what institutions are selling (along with paid media houses who support that nonsense). Always look at those sectors where the institutions are buying.

Come to think of it:

140 crore population that is consuming constantly has extremely poor waste management records.

Kavya of KK Create will go down as the finest content creators on YouTube in times to come.

Her video on India’s tallest dump site (click here) is not just a question to the authorities but to as civilians to wake up and initiate the change.

As per Wikipedia report, India generates 62 million tonnes (61,000,000 long tons; 68,000,000 short tons) of waste each year. About 43 million tonnes (70%) are collected, of which about 12 million tonnes are treated, and 31 million tonnes are dumped in landfill sites.

It’s an alarm for all of us to wake up!

FIIs have already understood it and are slowly putting money in various startups too that are covering the Waste Management issue (more details on it later). They have identified the sector that will make money for them over the next decade.

Hence, rather than blindly following cartoons on CNBC everyday, sit with your financial advisor and discuss the next big theme for India’s growth story. Because from the looks of it, it’s definitely not the ones that are being currently talked about.

Story #3: Is Gold Jewellery a Good Investment? Beware 30% Hidden Loss! (click here)

The article suggests that while gold jewellery is a meaningful and culturally significant asset, it is generally less efficient as a pure investment compared to gold bars, coins, or digital gold.

It is best viewed as a long-term investment combined with personal enjoyment rather than a purely financial instrument.

Here are a few points:

Tangible Asset with Dual Value: Gold jewellery combines intrinsic value with aesthetic and sentimental appeal, making it both an investment and a wearable asset. It is a physical asset that can be passed down generations.

Hedge Against Inflation: Gold jewellery tends to retain or appreciate in value during economic downturns or inflationary periods, protecting wealth.

Liquidity: It can be relatively liquid since it can be sold or pawned in emergencies, though resale prices often focus on gold content rather than craftsmanship.

Cultural and Emotional Significance: In India, gold jewellery holds strong cultural and emotional value, often linked to traditions, weddings, and festivals, adding to its desirability beyond pure investment.

Appreciation Potential: Over time, as gold prices rise, the value of gold jewellery generally appreciates, especially for high-purity pieces.

Drawbacks:

High Premiums and Making Charges: Jewellery includes costs for design, craftsmanship, and branding, which can reduce investment returns compared to bullion or ETFs.

Wear and Tear: Frequent use can cause physical damage, reducing weight and resale value.

Resale Challenges: Selling jewellery at a price reflecting its purchase value can be difficult, as buyers often discount making charges and focus on gold purity.

Not a Passive Income Source: Like other gold forms, jewellery does not generate income and profits depend solely on price appreciation.