Indigenous Investors Weekly Insights!

Top 3 well curated stories from the stable of Indigenous Investors incase you missed them. These can range from finance to sports, depends on what made the headlines. Stay tuned.

This week we cover the following:

Dr Lal Pathlabs maintains the leadership position in India’s Diagnostic market

RHI Magnesita returns to profit trajectory

Maruti Suzuki - The emperor who lost his clothes

Our thoughts are with the victims and their families of the dreaded Pahalgam Terror attack and subsequent attacks from Pakistan’s terror groups.

Over the past weeks, we have communicated our feelings on the matter to our readers. We stand with the Indian armed forces and strongly believe in their capabilities.

At the same time, we also need to acknowledge the shortcomings of the current Government.

There’s a big talk about ‘aatmanirbharta’ but very little to show.

But if there’s any seriousness then Air Chief Marshal Amar Preet Singh asked private sector “…to do a very special thing…(in what could be) their finest hour”, invest at least 10 per cent of earnings in R&D, start designing and developing in India, and importantly, honour the contractual commitments given to the Armed Forces.”

Indian Express has written a fine piece on this - India Air Chief’s comments on delays in major defence projects call for introspection on issues plaguing manufacturing (read here)

Needless to say, the Government need to support private R&D and product development through MSMEs, Startup Ecosystem in the defence segment.

Cut down the red tape, make sure these companies are not interrupted by tax mafias, land mafias and other labour laws whose sole job is to extract money for these political parties, while their foot soldiers are rewarded with free beers and some biryani at the end of the day for doing ‘vasooli’ for these companies.

While the Prime Minister and Commerce Minister talks about Indian Entrepreneurs as the backbone of the economy on various Global forums, they do very little to help.

Don’t believe us. Just look at the numbers.

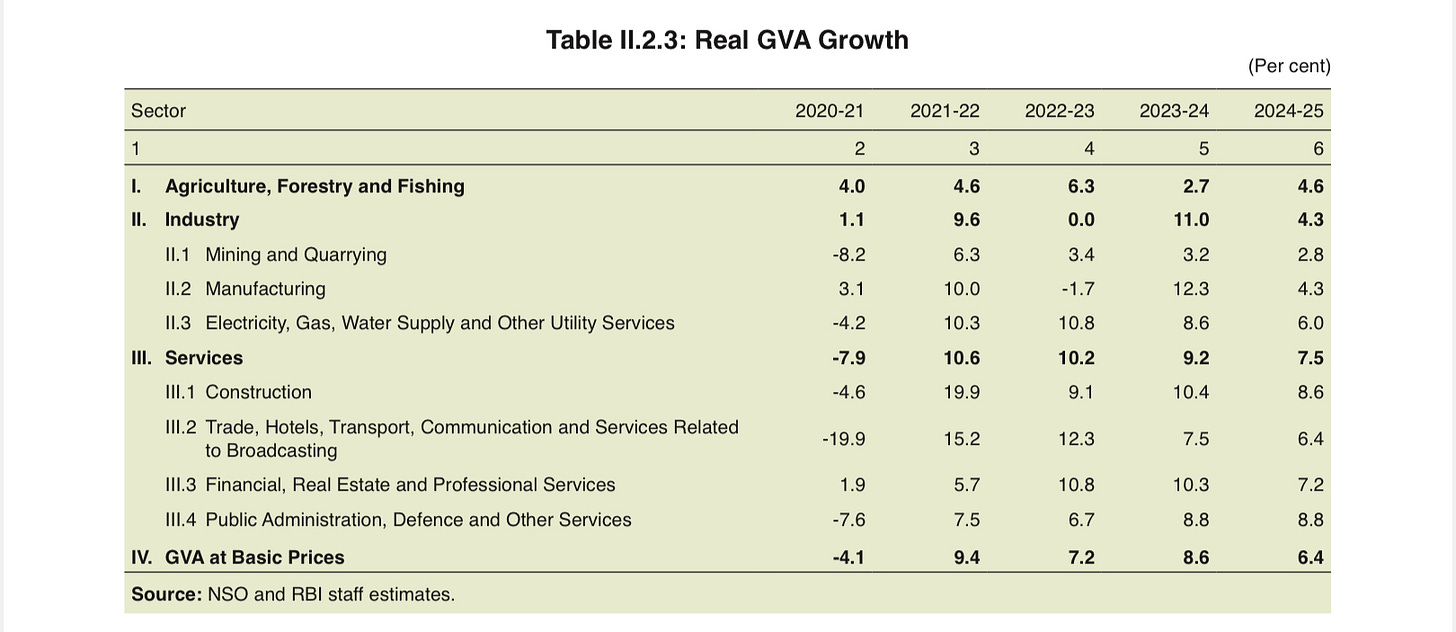

This data is published the RBI’s Annual Report of 2024-25.

A single glance at the numbers and you will realise that private sector in manufacturing, mining and quarrying and agriculture growth has simple lagged.

Growth has come from IT services (majorly), Construction that’s more of Government spending on roads, Financial services, etc.

Now, let’s look at this from another angle.

India’s total workforce is estimated to be around 54 crore people. Out of this 30% is in the private services sector which is around 16.2 crore.

And the private manufacturing sector employs close to 1.8 crore people only !!! (10% of the service sector)

Now, this is the current state of affairs.

So out of 54 crore people, only 1.8 crore people are employed in the private manufacturing sector.

China’s private manufacturing sector employs approximately 13.5 crore people.

Now, can we even compete with China?

We leave the judgement to our dear readers.

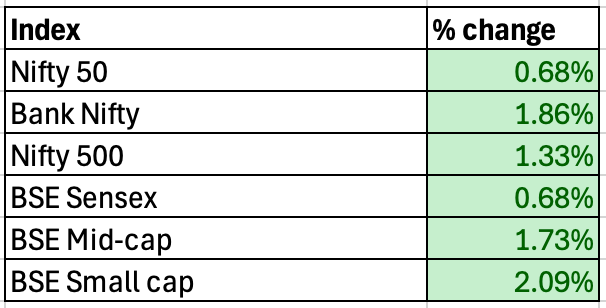

Now, let’s look at how the markets performed this week:

Bank Nifty raced ahead of Nifty50 and Nifty 500 because of the 50 bps rate cut that RBI Governor has gifted.

At the same time, Mid and Small Caps continue to move up.

In the world of diagnostic services, Dr Lal Pathlabs is par excellence. A strong management with clear focus on delivering value to it’s customers, employees and shareholders.

As investors, we see a prudent capital allocation from the company. They don’t go out for shopping small companies in order to grow. We haven’t seen any unnecessary cash being burnt in the name of ‘keeping up with competitors’. For us that’s not just a skill, it’s a culture that says we will grow at our own pace and maintain discipline.

Substantial cash reserve of Rs. 1,229 crore as on March 31, 2025, is held for "any opportunity which will emerge," particularly for inorganic growth in the South and West regions.

Such companies make money for shareholders in the very long term. But then investors are an impatient lot.

source: Indigenous Investors Research Desk

Integration with Subarban Diagnostics took a little longer than we had expected. Because the acquisition was completed back in 2021 but it’s integration was completed in the last quarter that’s Q4 2025.

Now that the impossible is complete, new markets such as Mumbai, Pune and Goa open up. We expect to see some strength in numbers from next quarter onwards.

There’s an increased competition from the organised as well as unorganised players.

However, the management is confident that it won’t impact their growth as the India’s diagnostic market in itself is very big. We too believe the same.

There will be large companies such as Lupin and other pharma companies wanting to set up their own shops, but it will be hard to compete. Because for them, it will be about starting one such project and not a business model in itself, so expecting a lot of seriousness from them to compete in this will be foolish.

Only time will tell.

Story #2: RHI Magnesita returns to the profit trajectory but stock price still lingers (click here)

RHI Magnesita is in the business of manufacturing special refractory products.

Refractory products are materials that don’t melt or break when they get very hot. They protect equipment in factories that work with metals, glass, or other things that need a lot of heat.

In a nutshell, it’s a critical component in metal, glass, steel, etc sort of factories.

The company holds 30% market share in India.

The company has made a strategic choice not to engage in a "rat race" of price erosion to gain market share. This decision aims to preserve market health and value, prioritising healthy competition over aggressive market share capture at unsustainable prices.

Consequently, RHI Magnesita has lost orders because it refuses to accept them at very low margins (e.g., 4%-5% margin with less than 0% EBITDA) and yet the numbers look super strong to us.

source: Indigenous Investors Research Desk, Perplexity AI

The company’s merger with Dalmia Refractories has proved a bit costly. Now, that’s nothing new when you are a foreign company merging with an Indian incumbent whose primary job is to hide all the skeletons in it’s skin and reveal only when it’s merged.

Hence, the last 2 years can be termed as lost years for the shareholders of the company. But we still believe in its ability to grow.

The Indian refractory market is projected to reach US $4.5 billion by 2030, driven by material innovations and organic growth.

However, the announced overcapacity expansion in India coupled with Chinese imports of refractory materials is becoming a systemic issue, resulting in price erosions.

This has led to intense competition and a degree of commoditization in certain refractory segments, particularly for non-critical products like ladle bricks and tundish working linings, where customers prioritize lower prices, even if it means compromising on consistency or long-term performance.

We have the faith in the company’s management and it’s exceptional skills of execution to pull this off seamlessly.

Story #3: Maruti Suzuki - The emperor who lost his clothes (click here)

Declining market share and a stubborn management. A match made in heaven.

Maruti for decades had been India’s premier choice for owning a car. But in the last 5 to 7 years, the industry has gone through a marked shift. And Maruti’s leadership have been caught napping.

"88% of the country is not participating in the car growth story that's because entry level cars are just not growing, so, we have to be conscious of that fact and sometime India will have to take a call on how to address this if manufacturing has to grow, and auto is a large part of manufacturing sector."

– Rahul Bharti, CIRO

Yes, the entry level cars are not growing. The reason is that even as first time car buyers, Indians are now ready to spend Rs 10 lakhs plus for a car. And if you are ready to spend that sort of a money, then a Skoda or a Volkswagen is a much better choice than the Swift Dzire.

For Indians, car is not just a vehicle to drive from one place to another. It’s a matter of prestige too. So if you want to buy a D’Zire that is more than Rs 10 lakhs and an Ola / Uber drives too drives one, you are surely going to avoid it.

That’s one reason why most people stopped buying WagonR despite the company trying it’s best to make the car a bit wider.

Here’s one more blunder.

Maruti have traditionally been against EV, not because of cost, but because they would’ve to rework their factories. It’s harder said than done.

That’s why you need startups to disrupt this space. Incumbents can’t do it.

"See we have to be conscious that by design EVs will have a much lower profitability and that's true for the entire industry. We can't expect EVs to have the same level of profitability as IC engines. And if they were, then the government probably doesn't need to have a 5% GST or so many schemes or so many support policies on that."

– Rahul Bharti, CIRO

The management fails to understand that slowly Indians are moving to EVs. Right now, it’s the upper class who are buying it. Then comes upper middle class. But very soon, we will see middle class join the club because for them electricity is cheaper than petrol.

And unlike other countries, Indians on average don’t drive their cars for long distances. So having that argument shows that the emperor has lost his clothes.

It’s for the shareholders to now push the legacy automaker into shifting it’s stance and start preparing for the revolution.