Indigenous Investors Weekly Insights!

Top 3 well curated stories from the stable of Indigenous Investors incase you missed them. These can range from finance to sports, depends on what made the headlines. Stay tuned.

This week we cover the following:

Mold-Tek Packaging aims to become significant player in Pharma packaging space in next 3-4 years.

PI Industries: amidst industry turmoil the management opt to defend their base like Rahul Dravid

Reliance Industries will double its investment in Northeast to Rs 75,000 crore in next 5 years: Mukesh Ambani

Our thoughts are with the families of those were victims to the dreaded Pahelgam Terror attack and subsequent attacks from Pakistan’s terror groups.

Our armed forces has given a befitting reply. And our Prime Minister has assured us that Operation Sindoor still ongoing and these terror groups and Pakistan (harbinger of terror groups) will be held accountable.

During this entire episode, Indians were surprised to see Turkey and Azerbaijan openly supporting Pakistan.

Think School has done an extensive analysis on How Turkey backstabbed India. It’s a must watch.

Adding an ironic twist, Ganesh notes that in 2024, Turkey banned India from buying these drones, despite India reportedly exporting drone-making components to Turkey.

India has been exporting items like aluminium, electronic components, telecom equipment, and aircraft parts which are eventually used to make Turkish drones that have attacked Indian borders.

Turkey just crossed all the limits!

As a result, Boycott Turkey gained it’s ground.

Around 3,30,000 Indians visited Turkey last year contributing around Rs 4,000 crores to their economy.

For Turkey it might just be 1% of their GDP, so they might just turn their head away. But just like Pakistan, they don’t understand the soft power of India.

This broader trend of Indian tourist arrivals in Turkey increased by 57% compared to 2018, and by over 25% from 2022 to 2023.

So what’s the angle of soft power for Indian tourists:

More than 2.5 crore Indians travel abroad every year

They have extremely high spending power

By simply refusing to visit these countries that have anti-India agenda, we put screws to their economy in the long run

So here’s our urge to Indians wishing to travel abroad.

Plan for your travel within India and spend the same amount, live in luxurious hotels, travel in the best vehicles, so on and so forth.

Here’s how you will help the Indian Economy

It will create direct employment opportunities in sectors such as hospitality, transport and entertainment.

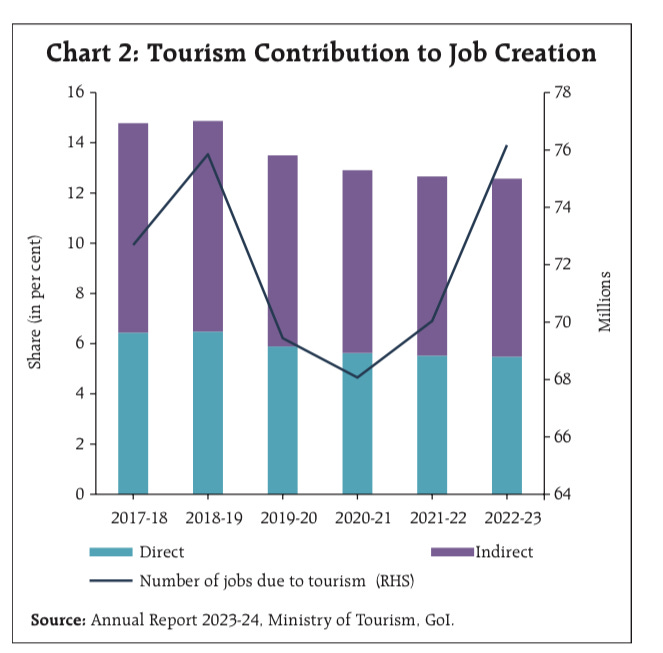

Travel and tourism have created 7 crores and 60 lakh jobs in 2022-23 (direct and indirect) = 12.57% of total jobs created.

Indirect opportunities for the associated sectors such as steel, cement, etc for building these infrastructure facilities

These infrastructure facilities such as roads, railways, airports and hotels support the local community by giving them jobs and opens up their view of the world

We will be able to preserve our national heritage sites and put more money in beautification of surrounding areas

Local artists and craftsmen will get tremendous advantage and a boost to their incomes

Content creators on YouTube, Instagram can visit these places and showcase it to the World that India too is a destination for a luxurious and long vacation

As we get more foreign tourists in India, they will not only help us with foreign exchange receipts but also foster our international relations

We don’t mean to discourage any International vacations, but just showcasing the advantages of the same money being used in India.

Now, let’s look at how the markets performed this week:

source: Indigenous Investors research desk

It’s not unusual to see Small Cap index being indifferent to Nifty 50 or Nifty 500. Plus, investors should also understand it’s not a signal of any sort that Small Cap is picking up.

In our research, we see that few companies have delivered decent results in the Small Cap space and the markets have rewarded them. While larger companies continue to face headwinds in their operations and hence we see index being on a flat line at the moment.

Tariff war continues to be a key concern at the moment for the markets. While Trump and Xi have their poker game sorted, others on the table will have to wait it out.

Mold-Tek’s Pharma packaging division has delivered exception growth by the end of it’s 1st year in operations by achieving over 50% in utilisation capacity of the unit.

Mr Lakshman Rao, Chairman & MD is super bullish too.

"One of the greatest news for the quarter is our Pharma division, which has started barely a year ago, has crossed break-even in Q4 with a sharp turnover increase from a meager Rs. 2.5 crores in Q3 to Rs. 6.7 crores in Q4, resulting in company making profits for the first time in the Pharma division too. So, this will augur well for the coming years as the traction created in Q4 will continue into FY25, apart from additional new products being added in the pharma sector."

"Pharma division growth will continue to improve. Definitely, this quarter’s performance will become the base now. For FY25, we are looking beyond Rs. 30 crores. It can get even better depending on new pharma products we are launching. We have taken up a minor expansion—apart from six, seven machines initially, we are adding five more injection molding machines. A couple have arrived, three more are expected by June. Corresponding molds will also be ready by mid-June, further boosting revenues by end of June. Hence, pharma division revenues are expected to see two and a half to three times growth from Rs. 11 crores (FY24) in FY25."

"Our investment stance has shifted from cautious to more confident. Results are encouraging—our ability to develop new molds and products has attracted significant attention from the pharma industry. There’s a major gap in new product development in pharma packaging in India. Mold-Tek’s tool room and product development capabilities position us well to fill this gap significantly."

The Financial Year 2023-24 was characterised by notable investments and significant challenges, reflecting the company's path towards growth and innovation.

Here’a comparison with it’s peers:

source: Indigenous Investors, Perplexity AI

PI Industries has been an apple of our eye.

The global crop protection industry is experiencing a transitional downswing, though mid- to long-term trends remain consistent. The sector is adapting to challenges like supply chain bottlenecks and input cost fluctuations.

Tariff wars and geopolitical scenarios are impacting global trade dynamics, potentially favouring Indian exports due to underlying demand.

Domestically, the generic segment faces ongoing pricing pressure and elevated inventory levels. Market sentiments for the next season will depend on investment trends and the rural economy's health.

PI's approach aligns with innovators, focusing on high-potential molecules and brands, which has helped deliver stable performance amid challenging market dynamics.

PI is evolving from an ag science company to a life science company, targeting a 10x market opportunity over the next two decades.

New Initiatives: Pharma, Biologicals, Electronic Chemicals

These areas represent new business ventures for PI, built on investments in talent, assets, processes, and customer portfolios. They typically follow a long-term J-curve approach and require time to shape and stabilise. While currently on a small scale, aggressive growth is anticipated in the next two to three years.

Pharma/CRDMO: PI is building a differentiated CRDMO offering. There are three interesting projects nearing a mature-gate approach, including a development project for a life sciences application that is a commercial product being tested, with potential long-term impact if successful (expected to know in the next six months).

Biologicals: PI has a leading-edge technology platform with patented proteins and peptide technology. PI is already among the top three players in the Indian biologicals market, with at least 15% of domestic revenue derived from biologicals. They aspire to become one of the largest biologicals players in India.

Electronic Chemicals: PI has already commercialised three or four projects over the last two years and is collaborating with global players in Japan and Europe. Two molecules have been commercialised this year, with another two in the pipeline for the next quarter. Over 50% of total inquiries are from electronic chemicals.

Proprietary Product Development: PI is working on a proprietary offering, including the development of the first AI (Active Ingredient) of an insecticide, 'PIOXANILIPROLE'. It is currently in Phase 3 trials to develop regulatory data for product registration in different geographies.

The CAPEX plan for the coming year is between Rs. 800 to 1,000 crore.

This investment aims to boost the region’s development and will focus on expanding Reliance’s presence in sectors such as telecommunications (Jio), retail, and energy.

Ambani highlighted Reliance’s commitment to the region, stating that the company has already invested Rs 40,000 crore in the Northeast so far.

The new investment will support digital infrastructure, job creation and entrepreneurship, contributing to the economic growth of the Northeast.

In short, Reliance Industries will invest an additional ₹35,000 crore in Northeast India, taking its total investment to ₹75,000 crore in the next five years, focusing on digital, retail, and energy sectors to drive growth and development in the region.

Think about this:

Northeast India shares it’s border with China. And as we are well aware that China is interested in bringing some chaos to India as it wants to be undisputed in the South East Asia region.

Plus, our Northeast is filled with tourist spots such as Sikkim, Meghalaya and so on.

Last year as in 2024, the region saw 80 lakh tourists visiting them. 100% growth from it’s previous year (2023). Majority still comprised of domestic tourists, but slowly even international tourists are showing interest.

Kavya Karntac, India’s face for YouTube visited Meghalaya, the home to the rainiest places on earth: Cherrapunji and Mawsynram; breaks its own records year after year for the wettest place on earth! It’s got 55 lakh views already & counting.

It’s a brilliant documentary about the place and it’s people. Must watch!

Life inside WORLD'S WETTEST place! (click here to watch)

Northeast is a strategic place for tourism, handicraft industry and a time away from the busiest cities of India.

Developing this region could bring about Rs 1 lakh crore to the country via direct and indirect employment opportunities.

That will also force our neighbour China to be in check, if they wish to ever infiltrate!