Our Take on... Dr Lal Pathlabs Ltd

India's diagnostics market is set to double to $20 billion by 2026, with pathology and imaging segments. Established players face competition from startups offering lower-priced wellness bundles.

India’s diagnostics market is estimated at $ 10 billion in FY 20 and is expected to reach $ 20 billion (Rs. 1,360 crores) by FY26.

The market is divided into main two segments, namely:

1. Pathology (60% of market)

2. Imaging/Radiology (40% of market)

Pathology market is highly fragmented;

1. Unorganized standalone mom-pop centers – 46%

2. Hospital based diagnostic centers – 37%

3. Organized share – 17%

The organized market comprises some marquee names such as Dr Lal Pathlabs, SRL Diagnostics, Metropolis, Thyrocare, etc.

Opportunities in India’s Diagnostic Market

A person doesn’t need to be a genius to see an extremely bright future for India’s diagnostic and healthcare markets. The reason is straight forward. A sedentary lifestyle, lack of exercise, long hours of stressful work and much more, has resulted in a rise in the number of heart attacks, organ failures, lower immunity against viral infections, etc. On top of all this, India is a young nation adding into workforce by thousands on a daily basis and a cultural shift into nuclear families has increased its reliance upon packaged foods that are not always healthy.

The result? India accounts for approximately 60 per cent of the world's heart disease burden (ICMR study) while it is only second to China in number of diabetics in the world. Having said that, education is also playing its role in making people aware on the topics of health and wellness. Due to this, a lot of people have also taking regular rounds to such test centres for preventive assessments.

We may be living longer, but we are not living healthier.

That’s why an entire industry of healthy lifestyle alternatives has come up that includes vegan food, online yoga, organic food, etc. These companies are in a war zone to make us healthy.

With increasing awareness and early detection of life-threatening diseases, the diagnostic sector is set to become one of the fastest growing sectors in the decades to come. When we consider healthcare spending such as a hospitalization for a treatment of a disease, diagnostics tend to cost around 4-5% of the overall expenditure. These are essential and non-negotiable expenditures, some of which are covered by insurance while the majority of diagnostic costs tend to be an out-of-pocket expense.

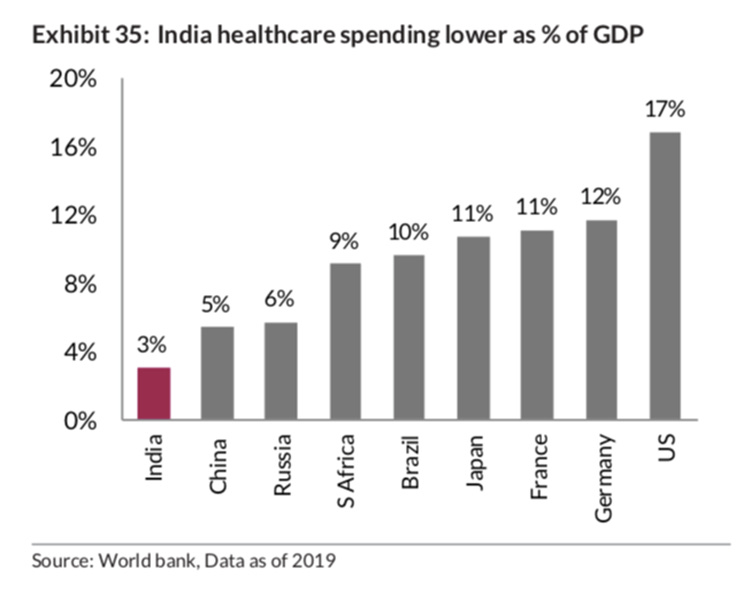

The reason for this is the lack of infrastructure. It’s surprising to note that India’s healthcare spend as a % of GDP is merely 3%.

A country that is home to 20% of World’s population spends less on healthcare than its peers. In the coming years, this segment will be addressed by private and government institutions together if we wish to become the 2nd largest economy soon. India is the ‘Pharmacy to the World’ due to our innovation in cheap generics that we export to multiple countries and yet we have some ground to cover in the diagnostic and healthcare segment.

That’s one of the reason we see incumbents in the diagnostic sector coming under tremendous pressure from the startup and venture capital ecosystem. The market is too big to be addressed with these pathology labs being high Return on Capital Employed (ROCE) Businesses.

It’s a simple adage, fish where the fishes are! Hence, the intense round of competition.

Hence, startups and online players like Tata 1mg, Pharmeasy and Redcliffe have displayed a sustained and fierce competition to the incumbents. It’s important to note that their bundling of wellness/ chronic routine tests come at a disruptive pricing at 40%-75% lower than incumbents with service offerings spreading across Tier 1/2 cities.

As we write this article, there’s been a sense of funding winter for such companies that has resulted in increasingly scarce funding and high customer acquisition costs. Hence, these companies have now reduced those ridiculous discounts once offered to gain market share.

Now let’s take a look at the poster boy of listed diagnostic ecosystem – Dr. Lal Pathlabs Ltd.

Dr. Lal Pathlabs operates a network of 277 labs, 5102 Patient Service Centres & ~11,000 Pick-up Units, 36 NABL-accredited labs, and 2 CAP accredited Labs. Its flagship labs include National Reference Lab in Delhi and Regional Reference Lab in Kolkata, Bangalore & Mumbai. As of June,23, company has a catalog of 481 test panels, 2,763 pathology tests, and 1,947 radiology and cardiology tests. It has also entered the area of genomics which offers a wide range of key tests related to oncogenomics, neurogenomics, etc.

The company commands TRUST in the North India with 62% of the revenues emerging from the geography. On the backing of such a trust, the company has entered into its biggest expansion phase by acquiring Suburban Diagnostics to expand its footprint in the Western part of India. West currently accounts for a mere 16% of the company’s revenues. The recent acquisition will look to change it.

An investor should keep in mind that there will be a shift from an unorganized market to an organized one. But the battle will not be straight forward. There will be blood on the streets. If we consider FY26 estimate of the industry at $ 20 billion and 47% of it being unorganized, there is close to $ 10 billion of the industry up for grabs. To put it in perspective, $ 10 billion was the diagnostic market in FY 20 combined.

Think about it.

Our channel checks suggest that the unorganized market consists of pathology labs run by individuals who are nearing their retirement. Their next generation is either not interested in running the pathology lab or are looking to exit the business.

Exit for them comes in 2 ways.

First is to sell the entire path laboratory to a bigger player. Second is to sell the machines to a hospital diagnostic center or any diagnostic chain.

Based on this, we believe Dr Lal Pathlabs’s acquisition of Suburban diagnostics is in the right direction. We expect further such acquisitions from the company in the next few years.

A comforting factor for an investor is that the company is ‘net debt’ free. As per the FY 23 Balance Sheet, the company has outstanding borrowings of Rs. 420 crores that will be repaid over time. To counter this, the company has a cash balance of Rs. 665 crores on its books.

In the battle for gaining market share going forward, the ability to generate strong cash flow and deploy it quickly will become an immense competitive advantage for the company.

In a nutshell, Dr Lal Pathlabs is strong on 4 fronts.

1. Pan India network for Pathology and Radiology tests

2. Positive cash flow and ‘net debt’ free Balance Sheet

3. 75 years of solid experience in expanding the chain and remaining profitable along the way

4. Standardisation of reports across the brand name including reports of other labs that rely on Dr Lal Pathlab for their diagnostics

Of lately, the company has struggled to take advantage of synergies arising out of it’s Acquisition of suburban diagnostics. Like any CapEx undertaken by a company takes about 2 to 3 years for testing sampling and commissioning, similar line of trend is followed when a company acquires another sizeable company.

There has not been much growth in the sales, the margins have come under pressure owing to one time costs relating to the acquisition and other additional costs incurred for integration of the 2 companies.

We believe that the days of uphill struggle are now behind us and we will be able to see better results with expanding margins coming out of the company by this year end.

Conclusion

As lifestyle related diseases increase the Indian diagnostic and healthcare sector are expected to play to a vital role going forward. However, an investor should expect the entry of a lot of players with deep pockets. They will disrupt the incumbents. There will be a war. In such times, brokerages will provide extremely different opinions of buy and sell. For an investor such a situation becomes extremely difficult to hold onto his conviction. Many will fold their positions during this war and would like to stay away.

If history is of some learning, then investors should use their simple common sense. In war times, companies with a strong and positive cash flow will be able to ride out the complete (bull and bear) cycle. And once the war is over, these companies will emerge as winners. Investors who hold onto such companies will feel pain in the short term but will definitely be rewarded in the long term.

A simple study of companies such as HDFC Bank, Kotak Bank, Infosys, TCS, Wipro and Asian Paints help us prove this point. They have created massive shareholder wealth for those who have believed in the company’s ability to tide over the difficult periods and remained invested.

Buy and forget is easy to say, hard to execute.

Disclaimer: Indigenous Investors is a subsidiary of Zaveri Savla Consultants LLP. This article has been written to share our thoughts on the company under assessment. In no way, this is an investment advice of any sort. An investor is supposed to do their own research about the company and base his buy/sell decision on the same.