Our Thoughts on.. Bajaj Housing Finance

Exploring how the company’s stellar growth, technological integration, and customer-focused approach outshine its reliance on the Bajaj Group’s reputation.

We have been actively tracking Bajaj Housing Finance Ltd, a subsidiary of Bajaj Finserv Ltd since last couple of years. Its impressive growth is backed by strong execution of the team with the use of right technology and cross selling opportunities that come from Bajaj Finance Ltd.

Group dynamics is just a very small part of the equation. In our understanding, its impact is just 5 – 10% on the business of the company. Hence relying on the laurels of Bajaj Group might give a limited impression to investors.

The company focuses on mass affluent clients with an average age of 35-40 years and with an average annual salary of ₹ 13 lakhs per annum with the highest share of salaried customer at 88%.

Investors should rather be looking at excellent execution of the company which has resulted in its Assets Under Management (AUM) growth of 24% CAGR in the past 5 years.

In simple terms, the company has grown by 3x or 3 times in the past 5 years. That’s just brilliant.

Just for context, India’s retail credit growth has been at 14.3% in the same period. But most importantly, the retail housing credit growth has been just 7% CAGR, that’s just 1.4x or 1.4 times.

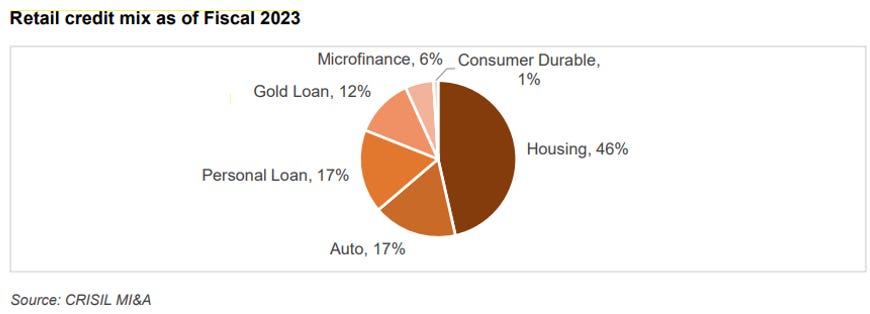

Housing credit forms 46% of the total retail credit in India.

Now, let’s just look at the skewed demographics of Housing Credit in India as at Dec 31, 2023

Top 10 states = 81% share approx

Top 5 states = 57% share approx.

Business dynamics

Source: DRHP, Indigenous Investors

Home loans form a major chunk of the company’s business. Although, it has dipped a bit in the past 3 years giving rise to Developer Financing and Lease Rental Discounting. But we believe that it’s just a temporary trend and there’s nothing for investors to worry about in times to come.

In our opinion these are the 5 competitive advantages that Bajaj Housing Finance currently commands.

Brand Equity

Cross Selling

Customized financial products

Dealer network expansion

Digital and Technological Integration

A look at where the company currently stands in correlation to its investors.

Fastest growing and second most profit-making Housing Finance company in India with a profit after tax of ₹17,312.2 million in Fiscal 2024 (Source: CRISIL Report) with our Return on Average Assets of 2.4% and Return on Average Equity of 15.2% as at March 31, 2024.

The largest non-deposit taking HFC (in terms of AUM) in India.

Lowest Gross Non-Performing Assets ratio of (0.27%) and Net Non-Performing Assets ratio of (0.10%), among large HFCs in India as of March 31, 2024.

Second highest loan disbursal of ₹ 446.6 billion after LIC housing Finance with loan disbursement of ₹ 589.4 billion in Fiscal 2024. (not too far behind)

Our Concluding Thoughts

Bajaj group in the financial services space commands a strong trust amongst investors. This has been earned over the past decades thanks to a strong earnings growth that has resulted in massive compounding for long term investors.

Housing finance is a strong space for investors to park their capital for the next 25 to 30 years. Contrary the popular opinion that the next generation doesn’t wish to have their own homes, Bajaj Housing Finance has seen a strong growth. The company understands its target market really well and is ready to cater to them.

A low spread of non-performing loans is an indicator of its ability to lend and recover the money. Hence, reducing the need for constant equity dilution (in the case of PSUs) to raise funds.

This is a developing story and we will be covering more of this in times to come. Stay tuned to our newsletters.

Prepared by: Team Indigenous Investors

Jinay Savla, Co-Founder

Swayam Kshatriya, Research Associate

Disclaimer – This is meant for educational purposes only. In no way, this has to be considered a stock tip. Please consult your financial advisor before investing.