Portfolio reshuffling

It is wise to revisit your old ideas and test them against such turbulent times. Read through to understand how you can reshuffle and take advantage of the situation than being cornered by it.

There is no secret that the valuations in the markets have reached the levels that are unfathomable by even wisest of minds. People who are already invested are worried that their gains will wane off while people who have missed the bull run and are aspiring to invest are worried that the markets will start falling and they will lose their capital. In both cases, the denominator is that the markets are expected to fall. However, the markets continue to spiral upwards proving everyone wrong every day.

Post covid recovery, this bull run has seen many events that should theoretically tame the animal and apply breaks to its unbothered galloping. It wouldn’t be wrong to claim that these external shocks could’ve put the market in the reverse gear (which is widely expected since a long time).

Source: niftyindices.com, Indigenous Investors. Downfall months of Covid ignored in calculation

Even if we are to ignore the external shocks the way market has already ignored, the prolonged high interest rates scenario should’ve done the trick to slow the run. We will explain in detail about the high-interest rate scenario and its impact in another article.

The markets continue their upward trajectory with such ferocious speed and raise a lot of eyebrows and concerns regarding the sustainability of the bull run. In the long term, the markets usually align with the earnings trajectory of their constituent companies. This happens because in the long term, all the short-term sentiment and noise regarding the companies take a back seat and the true picture that remains are the numbers these companies have been able to make over that term.

In such a difficult scenario, what should one do with their portfolio?

One approach is to understand the construct of portfolio - and this will be different for each person. Before getting into details, the first thing to be done is to get rid of those insignificant, inconsequential bets you had taken because a friend recommended you or you overheard someone on your way to work. These bets only populate your portfolio and barely offer you any gains even if they were to. Bear in mind that this approach will make sense only for those who look at their portfolio as one body and are interested in generating long term wealth.

Also note that if you are looking to liquidate your investments for some other purposes like purchasing a house or for marriage in the next 6-odd months, it is best to liquidate that sum at current value. Shares give you the best returns over the longer run but are very volatile in the short term. It is not wise to be greedy for another 5% or 10% in the next six months and risk your goals and aspirations. Things can easily go the other way in the blink of an eye.

Think of dividing your portfolio into 3 categories -

1. Heritage stocks

Heritage stocks mean those investments that were a) done long back or passed on from your predecessors or b) have grown so much over time that you feel they will never be available at the price you purchased. These are investments in companies that have stood the test of time and generated returns for its shareholders. The best part about such stocks in your portfolio is that even if the value is to fall by 50%, you would still be in the green because your purchase price is so low.

It is highly likely that the dividend yield based on your cost is higher than the dividend yields available at current price. (Dividend yield can be found by dividing the dividend received for the year with your cost of purchase of those shares). Irrespective of the dividend you might receive, if you feel that the company has done well over the years and it is highly unlikely for the prices of these shares to come down to price that you have paid for purchasing them, retain the stock in your portfolio.

2. Resilient companies

In addition to the stocks in point 1, there will be some true quality companies that you have discovered and invested in. It does not matter whether you invested in them a few years back or yesterday, if you know and are confident that these companies are doing well (in terms of their returns, not in terms of share price), hold them close to your chest. Keep adding them in case the stock price falls.

Question may arise that if the market is falling, why the hell are we recommending to hold it? Why not sell it now and buy when they are available at much cheaper prices? The two word answer for this is ‘market timing’.

Market timing means knowing (or attempting to know) the exact timing of when the stock price is going to rise or fall and making suitable trades at those exact points to get maximum gains in the process. Timing the market is extremely difficult (borderline impossible).

Four things you should remember about market timing is-

a. If we knew market timing, we would not be writing this article but directly informing our decisions of buy, sell or hold for every stock in the universe.

b. If we knew market timing, we would not be doing any business (because we wouldn’t need to) and only investing our own money and enjoy our already retired life on a beach or top of a mountain.

c. Even if someone claims to know market timing and implements it well, the resulting gains are not substantially different over long term versus someone following buy and hold strategy. This is also because market timing consistently involves transactions that attract costs, taxes and fees.

d. If our expectations of markets falling turns out to be false, like it has happened with the world in the past year and a half, you will miss the opportunity of making money from these favourite companies by sitting on the shore waiting for the right time.

The only thing you can do here is trim your position (partial sale) and book some profits if you think that the stock price has reached unreasonably high levels and even at a good pace, the company’s returns will take some time to make sense of these prices.

3. Trial and error

Lastly, you will have some stocks in your portfolio that do not fall under the above two categories. These stocks will most likely be held as a tracking position (shares that you want to invest in but are still considering whether to invest a sizable amount), shares purchased very recently, momentum buys, tactical bets, shares that are not fundamentally great but have offered you higher than expected returns and so on.

In a falling market scenario, its best to sell them off. Please note that the selling of these stocks must be irrespective of whether you have made profits or losses out of them. You do not want to be in a situation in which you lose out on all profits of the stocks in green and go deeper into losses for the stocks in red.

The big question

Now that we have made all the adjustments in our portfolio to make sure that we are keeping up with the changing dynamics – both, macro and micro, a pertinent question remains to be answered.

After rebalancing, you are left with anywhere between 25% to 60% of your portfolio value in cash and we already know that keeping cash idle will only erode its value. Besides, it is already difficult in the present to time the market, it is just impossible to predict when the bulls will return in the future. The big question here is –

What do we do with the cash that we have now?

Don’t worry, we got you covered. There are two things you can do with all the excess cash you have accumulated with the above exercise –

1. Park all your excess money in liquid funds but with a very specific purpose.

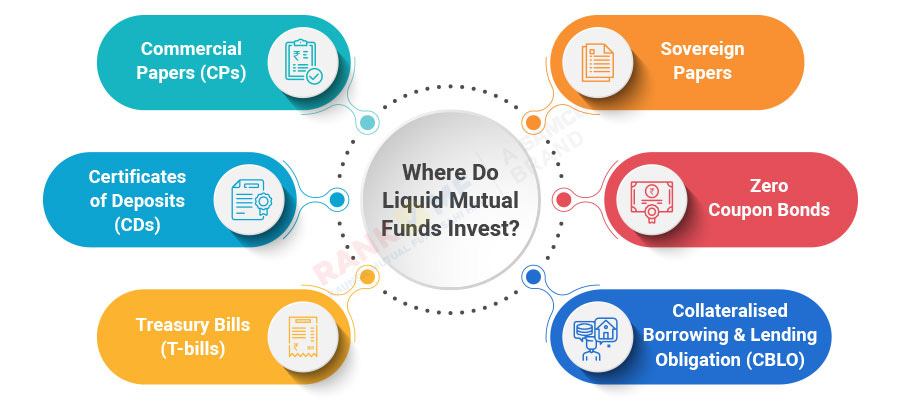

Liquid funds give you the flexibility of withdrawing your money anytime and offers you a return similar to fixed deposits. The advantage of liquid funds over fixed deposits is the flexibility offered by them as you do not have to lock in your money for any predetermined period and yet earn returns closer to the FDs.

Source: rankmf.com

It is important to note that parking your money in liquid funds is only for the short term. If you think you can park your money here and forget about it for a long period of time, inflation will eventually eat away all your gains.

The purpose of parking your funds here is that since you have the flexibility to withdraw them anytime, you can take advantage of the dips in the share prices that the market might offer you time and again and buy new shares you like or add to the shares already in your portfolio.

2. Diversifying your portfolio with some exposure to precious metals

If you are confident about the increasing uncertainties in the markets like slowdown of demand, FIIs and FPIs doing back and forth in the markets, recession, wars, de-dollarisation and other such events, you can slowly start investing in precious metals like gold and silver.

We are aware that these metals have already performed better than the market indices have. So, the idea is to keep investing at particular intervals so that you do not commit all your money at a higher price and at the same time, gain advantage if these metals were to go higher in the prices.

Another advantage of doing this is that you tend to reduce your overall risk due to diversification in such an avenue that has low to no correlation with the shares. We are now spoilt for choices when it comes to choosing the right investment option.

Source: financestrategists.com

We always have the option to buy gold and silver in physical form and you can always go for it when you have trust issues with the markets altogether in this scenario. If you wish to do it online, there are various mutual funds (gold funds) that offer you the returns and flexibility as owning it physically. We also have an option to invest in sovereign gold bonds that come with a lock-in and interest feature.

Conclusion

You can always follow the time-tested buy and hold strategy, and it can still work for you depending on how well you have built your portfolio over time. However, it is situation like this that prompt us to reflect on our decisions that were made years ago and test them whether they are still valid.

When we actually sit and perform this exercise, we get insights we didn’t know were obvious and yet, were missed.

For us, when we started to strategize this, the only thing we had in our mind is to rebalance, resize and make the portfolio resilient to the changing scenario. However, we found a few insights that changed the course of how we approached this from the very beginning.

First, we realized that the panic in the market is due to lack of suitable opportunities. Money flow was in excess and due to lack of good investing options available; investors turned their heads to the next best alternative which were not necessarily good, but enough to call them as investible. This eventually led to the broader base of the market rise which further led to a chain reaction of bystanders entering them looking at the momentum in their favour.

Second, global uncertainties like recessions and wars in the developed world prompted them to search for greener pastures among the developing nations. India was and is going to remain in a sweet spot with growing manufacturing industry, China+1 strategy, cheap labour, stable government policies and strong internal demand being the most populous country in the world.

This led to hordes of FIIs and FPIs enter the Indian bourses and compromised on their otherwise stringent mandates of investing in developing economies, and they too spilled over to the companies in broader indices. An average company in a good economy is better than a good company in a bad economy, especially when they are answerable to the clients on a quarterly basis.

Third, the pressure of expectations tilted towards the companies not based on the routine formula of ‘market reactions should make sense of performance by the companies’, but more on ‘performance by the companies should make sense of the current market’.

It is a sure-shot formula to failure as these unrealistic expectations will drag the markets down in-spite of the companies doing okay. The narrative will skew towards the India Inc not being able to live up to the expectations of the market. It is a dangerous time to be in, because this can easily be misinterpreted as ‘slowdown in demand’, which is not always true.

Fourth, external events led to institutions quickly pack their bags and be the first one to grab any opportunity that was new in the market. Reactions to the Japanese Yen and recent flocking of investors to change in Chinese Central Bank policies proved that the overvaluations in India are more of a result of excess liquidity in the markets and hence, unsustainable.

You can connect with us on siddharth@indigenousinvestors.com or jinay@indigenousinvestors.com for a detailed discussion.