Update on Aavas Financiers

The divergence between the performance of Aavas Financiers and the movement of its stock price in the last year had prompted us to write about their business. Aavas Financiers’ fundamentals have been resilient and consistent with its 1-year, 3-year and 5-year sales growth and profit growth around 20% and around 17% respectively. However, the stock market has made this stock out of favour of over a year, being shot down from 3000-odd levels in February 2022 to 1600-odd levels as on date. We had discussed this in detail in our previous article and you can read the same here - Our take on... Aavas Financiers.

The potential market size of Housing Finance Industry in India is poised to grow at a rate of 22% per year over the next 5 years. This growth is supported by their capacity to penetrate unorganised market segments and their adept appraisal skills. The smaller ticket size of loans, especially in the affordable housing segment is a sweet spot for such NBFCs as traditional banking institutions are too busy looking in all directions. Having a niche in a high growth segment provides strong tailwinds to the industry as a whole.

The AAVAS advantage

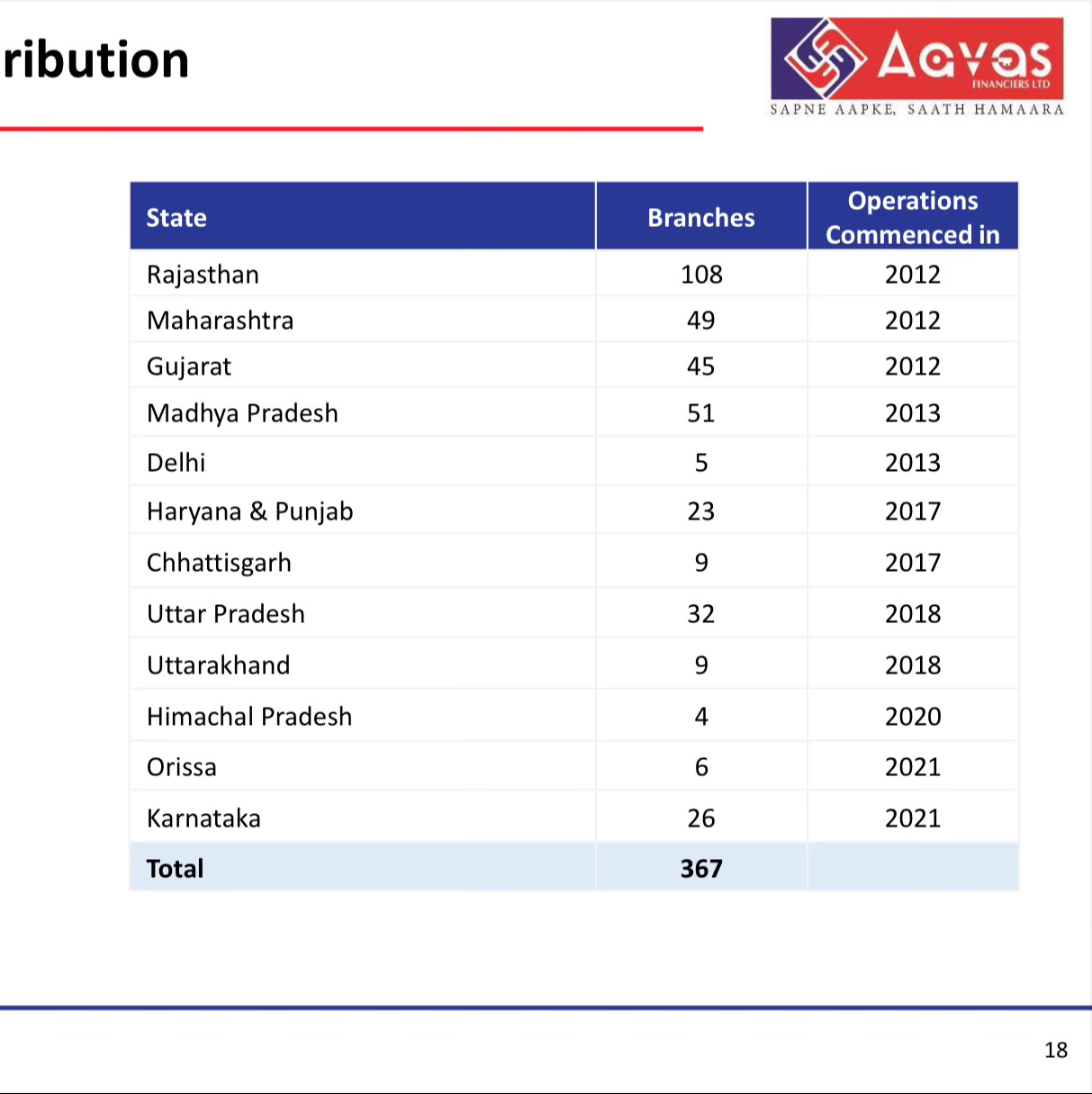

The focus of Aavas has always been to cater beyond Tier 2 cities right till the bottom of the pyramid where ‘Roti, Kapda, Makan’ is still a dream for the people. Aavas has perfectly positioned itself by consistently focusing on home loan segment followed by secured loans to MSMEs and self employed individuals. It has 55% branches located in the Western India region which is a hotspot for small businesses.

Aavas is focusing to grow its branches in the Southern India region. The region is heavily competitive but at the same time there is immense awareness about the housing finance products among the masses that considerably reduces their effort to educate and earn trust of people. The management understands the strength of the tailwinds that support the growth and are doing a simple job of being present at the right places.

Source: AAVAS investor presentation

Another factor that gives us a lot of comfort is that the average ticket size of their loan book is less than 10 lakhs. Since they are catering the housing segment, the Loan to Value ratio - amount of loan disbursed vs the value of property - is very low. This means any default in loan is sufficiently covered. This also means that the impact of a default is negligible on their overall health.

Bear in mind that these institutions are not in the business of auctioning assets of defaulters but in the business of rolling money. In spite of having a security to cover for defaults, these institutions are still adversely affected because ‘their cash flow doesn’t flow’. But an interesting point to note is that the segment covered by Aavas is the BHARAT part of India. This concept is beautifully explained by Tigerfeathers.

For the uninitiated, Bharat is not the nation of Apple stores, luxury malls, Broadway plays, fine dining, electric vehicles, cappuccinos, private schools, wellness retreats and destination weddings that the rest of the world commonly associates with the Indian growth story. No, Bharat is the prodigious segment of India (and Indians) that is a few steps further back in its economic trajectory.

This is the India of bicycles, farms, and government schools. It includes the estimated 1.3+ billion Indians that don’t speak English, and the 25% of Indian adults that lack access to a formal education. It is blue-collar India and small-town India, where per capita incomes typically range from $500-$2000 per year.

When this Bharat takes a loan to build their house, they are doing so to fulfil their life dream. Every inch of brick and mortar represents a part of their soul that they have engaged for decades to be capable enough to build something for their family that they can call their OWN. The emotions behind these four walls are as married to the future, hope and aspirations as they are to their past of incessant toiling to make ends meet. This Bharat is morally too mature to understand that such dreams cannot be fulfilled by cheating and deceit and never intends to default upon their commitment. And this attitude exactly reflects in the NPA (or Non Performing Assets) that is less than 1% of total assets.

AAVAS 3.0

Aavas 3.0’s forward trajectory is encapsulated in its ambitious 10-year strategy. With a target compounded annual growth rate of 20-25%, the strategy emphasises not only growth but also efficient market penetration. By embracing technology, reducing operational expenses, and maintaining a balanced loan portfolio, Aavas Financiers aims to cement its place in the evolving housing finance landscape. The aim is to invest more and more in salesforce who will provide last mile connectivity to those absolved of financing solutions due to infrastructural difficulties and puts a face on the institution’s name that inculcates trust among the people new to these services.

At the same time, Aavas 3.0 also aims to invest a significant sum in technological upgradation that will help them support their existing and new customers and reduce the turnaround time in on boarding the customer. This solution also aims at improving transparency in operations and inculcating trust.

Aavas’s revenue has increased by 22.9% year-on-year and EPS has grown by 15%. The metrics of net profit and EPS will improve as the additional costs in technology and manpower will become more efficient over time. Their branch network has increased from 346 to 367 branches catering to 2500+ towns and villages.

Source: AAVAS investor presentation

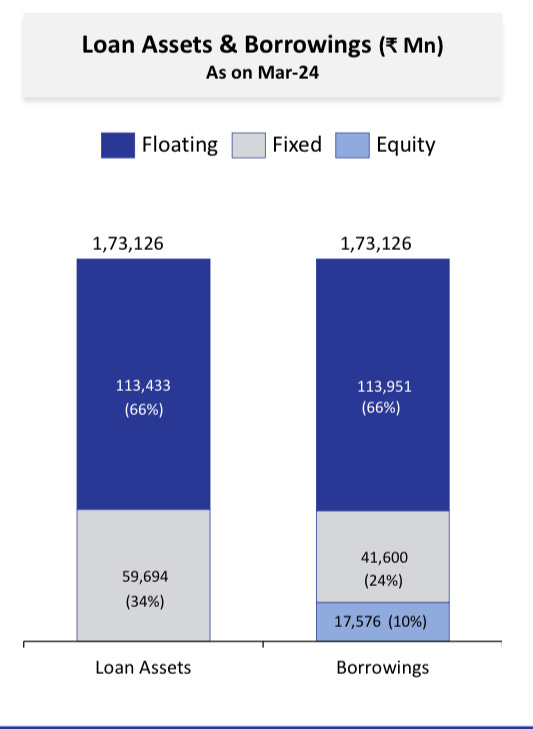

Strong Asset Liability Management

The management of Aavas has proven their business acumen with a robust asset-liability management. It is the process of using your assets and cash flow to reduce the risk of loss from not paying your liabilities on time. I will write a piece on this very soon to make you understand this topic in depth. Also, 66% of their assets (loans given) and liabilities (loans taken) are floating interest rates which considerably reduces the risk of interest margin mismatch due to economic cycles.

Conclusion

Aavas is enroute a consistent growth trajectory with all levers of business in a superior range that reflects the quality and commitment of management. Their market segmentation catering to households from Tier 2 cities to making in-roads to highly remote villages covers 80% of Indian households and a majority of MSME businesses. They have focused on improving customer experience by increasing their foot soldiers who identify prospective customers to understand their needs and act as a face of the company to imbibe trust and onboard them. In spite of India getting digitised at rocket speed, there is a different level of comfort among Indians when they know they have a person answerable to them in the time of difficulties. They have also heavily invested in improving their technological infrastructure that helps the company make quicker decisions, find data and resources on tap of a finger and improve customer experience by giving them necessary access to their account and reducing the turnaround time (TAT) post loan application.

Aavas is the dark horse in the space of housing finance and irrespective of the response received from the investors in secondary markets, we see great clarity in the quality and scalability of the business and expect it to continue growing at a good pace.