Update – Uptrend in Banking and Financial Services

Despite setbacks like HDFC Bank's merger delays, the sector shows signs of recovery, supported by improving balance sheets and renewed investor interest.

Last couple of years have been an anomaly in the equity markets. This bull market is an exception to the norm.

We saw Government pushing heavily on infrastructure, defense and oil & gas. To fund these projects, PSU banks such as SBI were asked to step up. These projects will have a very long-term impact.

In the next 20 to 30 years, we will see a very different India in terms of its quality of infrastructure and our incomes will shoot up and so will our ability to spend. Very soon luxury of today will become necessities of tomorrow.

Keeping this in mind, banking and financial services forms approximately 40% of your portfolio and our recommendations. We derive more comfort from the private sector, you will not see any public sector bank names.

But in the equity markets, these private sector banks did not perform according to our expectations.

There are 2 major reasons for this.

First – Interest rates went up and liquidity situation tightened

In the last 2 years, RBI raised interest rates to check for inflation. We have a slowing global economy, never ending wars, attacks in the red sea, so on and so forth.

As a result, every major central banks decided to keep high interest rates.

In simple terms, cost of loan just shot up. And large industrial houses who are the primary clients of private banks put a pause on their expansion plans.

In such a situation, personal loans shot up. As per RBI reports, an individual who takes personal loans has on an average taken 3 loans from different institutions to support their lifestyle. These are zero EMI sort of loans.

Financial institutions who lend freely to such people will face existential challenges in the future.

On the other hand, large private banks preferred to stay away from this segment. And they’ve done the right thing. Sacrificing immediate returns to be alive tomorrow is a wise decision.

Second – HDFC and HDFC Bank merger

HDFC Bank is the largest fish in the pond. And when it turns, even the water in the pond must change its direction.

Here’s the HDFC Bank’s market capitalization in the private sector banking space.

HDFC Bank had a bad luck. Their merger was put into trouble with rising interest rates. Their growth engine is on track, but the investors always demand something more.

However, the merger is now complete. Operations are smooth and the transition in leadership has been without any friction (till now).

And this can be seen in the stock price inching upwards and reached its all-time high recently.

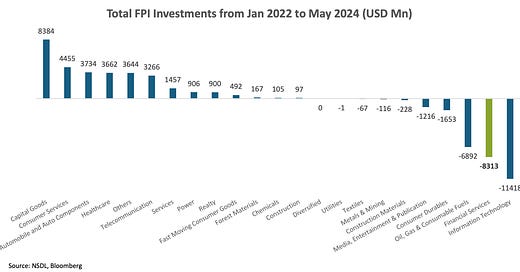

Even the Foreign Portfolio Investors chose to stay away from Indian Private Banking space till the merger was complete. Here’s the data.

In the last 2 years, we can see that FPI money was taken out from Financial Services (read Banking too) and put elsewhere.

And now slowly, we are seeing that money coming back.

We are also seeing improved balance sheets in the banking sector. Especially, private banks are healthier than public sector banks.

Net interest margin which is the outcome of interest earned from the customer and interest spent while borrowing money from the RBI or other banks, is better for private banks (green line). Same goes for other ratios.

Portfolio Implications

When we invest, it’s usually for 3 to 5 years. Our focus is on the growth of business and stock price together. Both need to coexist together.

In the short term, price and business growth can go in opposite directions. As investors, that’s the test of our patience. The correct way is to think about business growth and not worry too much about the price.

Yes, if the price falls by 50%, then it’s a clear indicator that the method of valuation is incorrect. So, our efforts should be towards making our method of valuation better. Even the great Warren Buffet or Rakesh Jhunjhunwala has made valuation errors.

So, investors who take a long view shouldn’t worry too much about lack of price movement in the short term. It’s an incorrect method of assessment.

Banking has been of a similar nature.

As of July 5, 2024 – here’s the FPI’s latest news in ET Prime (read here)

Overseas investors purchased nearly ₹9,200 crore of banking and financial services stocks in June.

I’m sure more capital will follow the suit. Because in the last 3 years, the numbers of Big 4 private sector banks have been satisfactory.

When the cycle turns back to quality stocks, these companies will reap the benefit massively and we as investors will be rewarded for our patience.

Allow me to close this report by quoting the genius investor – Mr. Warren Buffet

“The stock market is a device for transferring money from the impatient to the patient.”

Thank you for reading.

Jinay Savla

Indigenous Investors

Disclaimer: Indigenous Investors is the subset of Zaveri Savla Consultants LLP. Our founder is a SEBI Registered Research Analyst. This is an update on the stock we study and is meant for education purposes only. The content of this PDF is not meant for the larger audience in general. Any decision to buy or sell based on this PDF will not be a liability of Indigenous Investors, it will be solely at the discretion of the reader. This PDF showcases our viewpoint only and readers’ viewpoint can be completely different to ours.