What's up with... tariffs and oil prices?

We talk about the black gold and the impact on its prices due to tariff shock the world is witnessing

We're starting a segment where we'll explain how things move and what affects them. We'll bring this up whenever it's useful, so it won't be a regular series. If you like this segment, let us know what you would like to know more about and we’ll do our best to explain you in the language you can understand.

Global oil prices have nosedived in April 2025, considerably lower than their 2024 average. And they are expected to go further down.

When the tariffs were announced, oil prices fell just like stocks of other manufacturing companies and commodities that were explicitly mentioned in the tariffs. While it was obvious for the things that were explicitly mentioned to fall, oil prices joining the party to the same extent raised some eyebrows.

Source - tradingeconomics.com

Here’s what we think are the main reasons for the oil prices to fall -

The demand problem

The biggest concern regarding the oil prices today is the future. Due to tariffs being levied on practically every country and almost every item in the world, everything will start becoming more expensive for the largest consumer country in the world. This will lead to lesser demand by the citizens and the companies in the US.

Lesser demand means there will be lesser requirements of logistics and manufacturing companies using oil in any form across the globe will need lesser inputs for their production. While we see oil as just oil, the implications of lesser demand of oil actually extends to a number of industries.

Here’s a list -

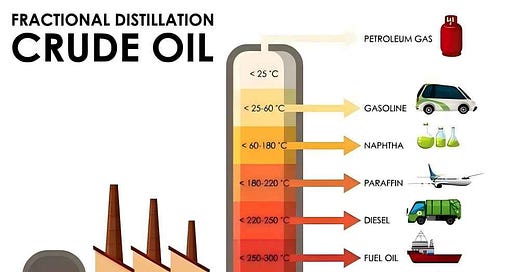

Petrochemicals, plastics, paints, packaging, fertilisers, pharmaceuticals, commercial heating, aviation, power, lubricants, construction, shipping, textiles, rubber, iron and steel, solvents, detergents, personal care products, FMCG, logistics and chemicals.

This is a list of industries that have crude oil as a direct raw material in various forms. Imagine the number of industries that will be added to this list if we consider the indirect impact.

Recession

The expectation of lower demand of items is indicative of recession and slowing global economic growth. Anticipation of slower economic activity has led to forecast of substantially reduced demand for oil.

Increase in supply

The OPEC+ countries (Organisation of Petroleum Exporting Countries including their allies) have already announced their intentions of increasing oil production starting this month to fill the gaps in supply due to previous production cuts. This will lead to surplus oil supply putting downward pressure on oil prices.

To add salt to the wounds, oil supply is expected to rise from countries outside the OPEC+ countries with US leading the charge by increasing its own oil production.

Strengthening US dollar

Since oil is always traded and priced in USD terms, a strong dollar would mean more expensive oil for the countries who have other currencies. This will put further downward pressure on demand leading to lower oil prices.

How does it impact you?

Whether we witness recession or war or neither of the two, one thing is clear - the Indian government has grabbed this opportunity with open arms. While the global prices have slumped to its lowest levels since last 4 years, the Indian government is filling its own kitty by increasing the excise duty on oil instead of passing on the benefits to the common man.

This means there is no change in prices for us in our daily consumption. We hope that they lower the duty if the prices go up in the future.