Why fixed income securities do not provide a good cover for inflation

Often, people have found their peace in fixed deposits and consider them to be safe. In context of absolute returns, they're right. But when we put inflation into this equation, things start sliding.

Fixed deposits so popular and preferred even today that when we introduce the term ‘Fixed income securities’ to someone, the first thought that comes to their mind is FDof investment starts with investing in Fixed Deposit (‘FD’).

Thanks to the various campaigns of the banks in India and the government, saving in FDs became a household phenomenon. FD facility is available in all the banks across the country, making it very approachable to everyone. Besides, it became a safe haven where you could park your extra funds and had flexibility to choose the term for which you wished to park them. They were simple to understand and offered an attractive rate of interest.

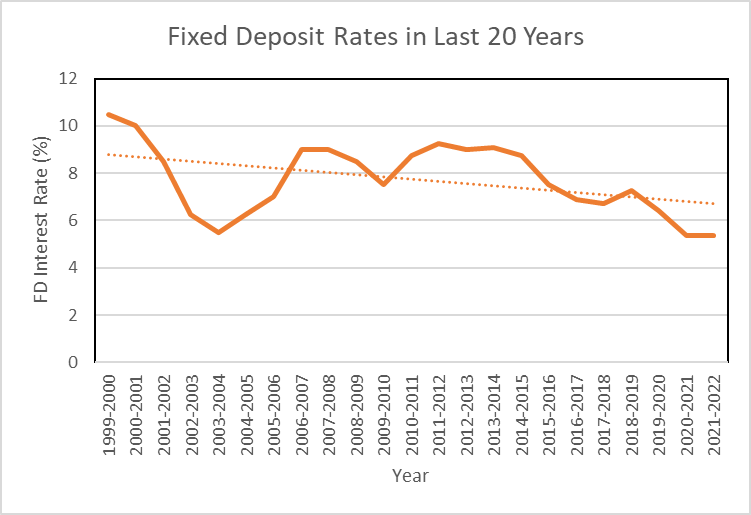

Investors had a stable, reliable source of income on their investment in FDs. The rates hovered between 8% and 10% for a long time. So, we can all agree that given the limited knowledge coupled with limited access to funds, FDs made sense (see chart below).

Source: bajajfinservmarkets.in

But like every love story we see around us, things start getting messier due to a villain. We call that party pooper ‘Inflation’.

Inflation means decline of purchase power over time. Inflation is the reason we do not keep money in our lockers. It is the reason we must stay busy and keep working for more than we earn today. It is why we must engage our saved money and invest at various places so that it does not lose its value. Consider inflation to be a character that eats from everyone’s tiffin and never shares its own.

So what can you do about it? Can you and I really tame such a seasoned beast that has plagued us with its horrors since eternity?

Consider this riddle.

Let’s say I give you a wooden stick and ask you to make it smaller. However, you cannot touch it or cut it. How’d you do?

It’s not so tough. Give yourself 30 seconds to think over.

You simply put a bigger stick beside it.

That is exactly what we need to do with inflation. You as an individual cannot control or tame it. But to get on top of it and deal with it, you need to earn at a better rate than inflation.

If you invested in a FD that offers you interest of 5% per annum for 10 years at a time when rate of inflation is also 5% which will stay constant for this period of 10 years.

This means that if your invest Rs. 1 Crore in FD at interest of 5% and face an inflation of 5%, the value of your money at the end of 10 years will still be Rs. 1 Crore, right? WRONG!

Typically, a fixed income security will give you returns at SIMPLE interest which means you will receive exactly Rs. 5 lakh every year for the next 10 years. Your total earning including principal at the end of the year will be Rs. 1.50 Crores.

However, the inflation grows at COMPOUND interest and the power of compounding can move mountains. Going by this calculation, the value of your investment after 10 years will only be Rs. 92,08,700/-.

Note

Discounting @ 5% means loss of value each year at 5% (inflation rate )

PV of payout is the Present Value of payout. It tells you how much your money is worth today

Year 10 figure is Principal + Interest as we will also receive principal back at the end of 10 years

This only implies that 1 Crore invested for 10 years in any fixed income security has led to loss in value for you. That’s why it’s usually said that fixed income securities do not provide a good cover for inflation.