Why we don’t invest in IPOs of startup companies

When we invest in startups, we dream of our invested company going the IPO route. However, as retail investors, we usually avoid them. Read on...

As long term investors, it is imperative for us to dig deep into the history of the company. This includes getting to the bottom of their management and their structure, their business design, the industry, their peers, the competitive advantage, the relevance of their products and the stability of the market to start with.

Investing for the long term is like a marriage. You just don’t blindly marry anyone who you find attractive because you know that attraction vanes over the long term. What stays longer than looks are the internal qualities like their conduct, their thought process and so on. What even stays longer are the principles and their experiences on the basis of which a person operates.

Just like a typical Indian arranged marriage, it is important for us to know not just the person (the business, its strength and weaknesses), but also their family (management, peers), their surroundings (market, opportunities and threats), their history and some recommendations from the people closer to the source (MDA, concalls, reports, ratings, etc).

When you have so much of knowledge of the background of a person, you can practically be sure of 80% (or more) about them. That’s a part of the answer to the always-ridiculed question of “How can you marry someone you just met?”. Pareto principal works here too ;)

I am very well aware that getting out of an investment decision is a thousand times easier than getting out of a marriage. But that is what we avoid by doing our research and digging deep the typical Indian arranged marriage way!

Just because you can, doesn’t mean you should.

The motive of all the scuttle-butting in arranged marriage is to find compatibility in the environments of the two people involved. When your environments match, settling down becomes a lot more easier and there is some correlation between both the people and where they are coming from.

Similarly, when it comes to investing in IPO of startup companies, we put a lot of weightage on ‘where they are coming from’.

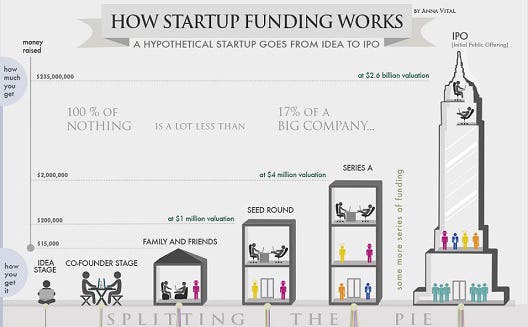

Startup companies may go the IPO route for various reasons. However, one common reason we have found among these companies is that they have to give an exit to their existing investors. These startups and their founders have always have seen a geometric progression in their growth through various rounds of fundings and partnerships right from the seed stage till the point of IPO.

These partnerships and investments are always valued more because they materialised when these founders and their businesses were conceived only in their minds. If you think anyone can raise funds, try raising for yourself. It’s not easy, especially when you are asking for a ton of money and have nothing to show in return (not even a promise of success)!

These startups make their way through the different stages of growth and rounds of funding on the backs of their investors and partners in order to become relevant in the market and in return, they reward these investors with hefty profits in their next round of funding by raising their valuations through their business success.

IPO is just another round of funding for the startups.

Just like in all previous rounds, investors expect the founders to reward them with hefty profits in IPO too. And the founders have to oblige to them because, one, they want to stay in the good books of the people who trusted them when no one else did and two, it is their fiduciary duty towards the investors to maximise their gains.

Does this ‘duty towards the investors (shareholders) to maximise their gains’ ring a bell? This is the same phrase we have come across a thousand times when we read about the duty of management of a listed company. So why should this be any different? If I were an investor in a startup that is taking the IPO route, I would be pissed if they didn’t give me the best possible returns.

Does this mean they don’t care about the new retail investors coming on board? Somewhat but not really. And this has to do with the conduct of the retail investors. I will try to write more on this topic later and build on the why’s.

Until then!